Your free Experian Credit Score

Join 13 million others who already have the UK's most trusted credit score. We'll help you see where you stand when it comes to getting credit.

Check your score for free

What you get with your free credit score

Getting the UK’s leading credit score could help you meet your money goals – such as getting a house, car, loan or credit card. The higher your score, the better your chances of getting the best deals. Plus, see if you can instantly improve your score with Experian Boost.

Your free Experian account lets you:

Find the right deals for you

We work with the UK’s leading lenders to give you deals you won’t find anywhere else. What’s more, we can help match you to offers based on your credit score. We do all the legwork so you don’t have to.

Apply for credit with confidence

We can tell you how likely you are to be accepted for things like credit cards and personal loans before you apply. We can even tell you if you’re pre-approved* for any offers, too.

Improve your credit score with Boost

See if you can instantly improve your score by using Boost† – only at Experian.

Get your free Experian accountCan you check your credit score for free?

You can get your Experian Credit Score without paying a penny, by signing up for a free Experian account.

Your free score will be updated every 30 days if you log in.

You can check your credit score as often as you like – checking it won’t harm it.

Check your free credit scoreWhat's a credit score?

A credit score, also known as a credit rating, is a three-digit number that reflects how reliable you are when it comes to repaying money. Your credit score is based on how you’ve handled money in the past. The higher your credit score, the better your chances of being accepted for credit, and at the best rates.

Your credit score influences your chances of getting:

How does a credit score work?

Your credit score is calculated whenever you apply for credit, such as a loan, credit card, mortgage, or even a mobile phone contract. How your score is worked out depends on the company you’re applying to – different companies have different methods and may use different information, so your credit rating may vary between them.

Lenders typically look at your borrowing history, your current borrowing, and other relevant information such as your income. Usually, they’ll look at information taken from the following:

Your credit report

Your application form

Their own records, if you’ve been a customer before

How’s your Experian Credit Score calculated?

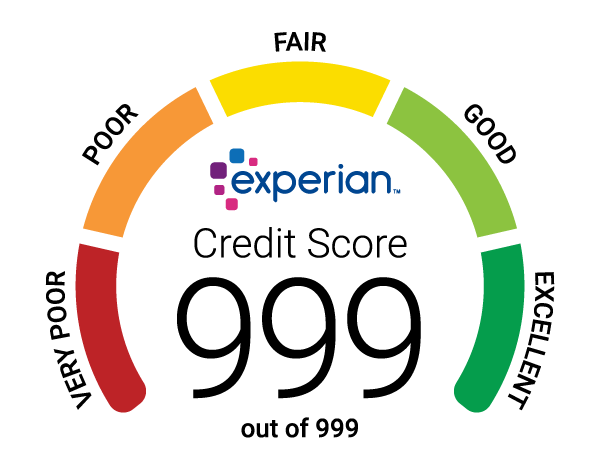

The Experian Free Credit Score runs from 0-999. It’s based on information in your Experian Credit Report – like how often you apply for credit, how much you owe, and whether you make payments on time.

You’ll lose points for having information on your report that suggests to lenders you’re unlikely to manage credit responsibly, such as previous late payments and defaults. You’ll gain points for things that lenders usually view positively, such as a track record of always paying on time and being on the electoral roll.

What’s a good or average credit score?

We consider a ‘good’ score to be between 881 and 960, with ‘fair’ (also the average) between 721 and 880. However, there’s no ‘magic’ number that will guarantee lenders will approve an application if you apply.

If your credit score is poor, you’ll probably find it harder to borrow money or access certain services. We consider a ‘poor’ score to be between 561 and 720, with ‘very poor’ between 0-560. But remember, lenders may have different views of what an ideal customer looks like to them, which will be reflected in how they calculate your credit score.

Your free Experian Credit Score is intended as a useful guide to give you an idea of how lenders may view your credit history. Knowing your score can help you make more informed choices when it comes to credit.

What does your Experian Credit Score mean for you?

Excellent

961 - 999

You should get the best credit cards, loans and mortgages (but there are no guarantees).

Good

881 - 960

You should get most credit cards, loans and mortgages but you might not get the very best deals.

Fair

721 - 880

You might get OK interest rates but your credit limits may not be very high.

Poor

561 - 720

You might be accepted for credit cards, loans and mortgages but they may have higher interest rates.

Very Poor

0 - 560

You’re more likely to be refused most credit cards, loans and mortgages.

Remember, your credit rating definitely isn’t set in stone. It can change regularly – for example, as the information on your credit report changes or as time passes. So, it can go up or down over time.

Experian has the UK’s leading free credit score – so you know you’ll be in safe hands seeing where you stand when it comes to getting credit.