The importance of carbon accounting

As the need for urgent action on climate change continues to grow, responsible businesses of all sizes in all sectors are acknowledging their contribution to the problem and recognising the need to take action that is both measurable and accountable.

Carbon accounting is an increasingly important tool that enables businesses to assess and report their current emissions, and gives them the insight they need to reduce their environmental impact and aim for net zero.

We take a look at the practice of carbon accounting – how it works, its aims and benefits – and examine the challenges it poses for businesses and lenders in particular.

What is carbon accounting?

Carbon accounting is a way for organisations and businesses to measure the amount of carbon emissions they generate, both directly and indirectly. It looks at their processes, inputs and outputs to identify and estimate their greenhouse gas emissions, and ultimately, determine their impact on the environment.

Named after carbon dioxide (CO2), the most common greenhouse gas and the biggest single contributor to climate change, carbon accounting is also referred to as greenhouse gas (GHG) accounting. It simplifies the measurement of GHG emissions by converting the varying effects of various climate-warming gases into a carbon dioxide equivalent value: CO2e.

What are greenhouse gases?

Greenhouse gases trap heat in the earth’s atmosphere, raising the average global temperature across the planet in a process known as global warming. The gases are released into the atmosphere through human activity, including through the burning of fossil fuels, agriculture, construction and manufacturing.

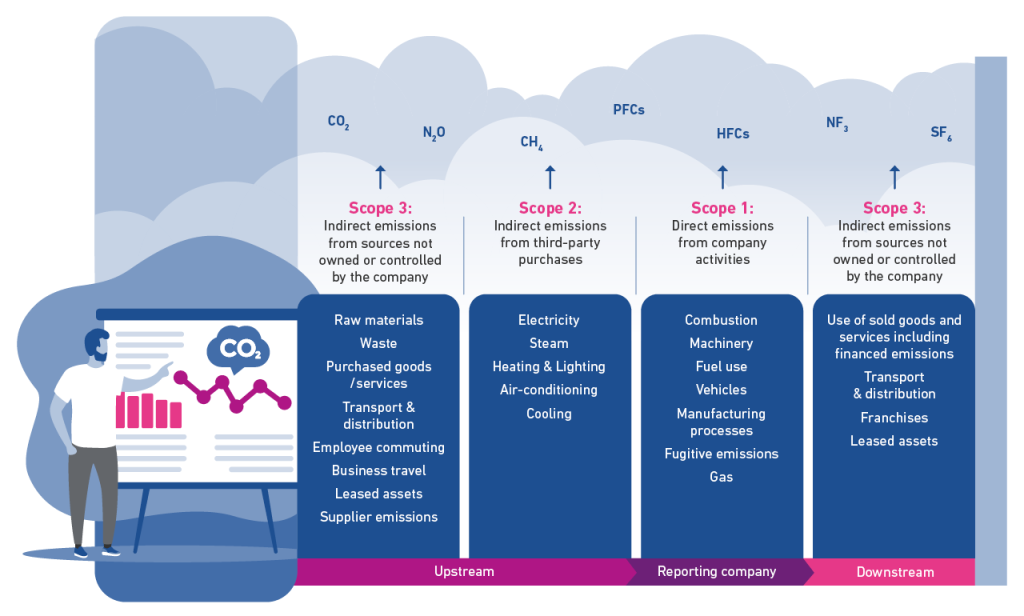

Seven greenhouse gases have been identified as accelerating climate change and warming our planet: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). In carbon accounting, these are all given a CO2 equivalent (CO2E) to make assessing their impact simpler. CO2e is the globally accepted standard for quantifying GHG and CO2 emissions.

Carbon accounting enables businesses to measure their carbon footprint and quantify their climate impact by converting various measurable business activities into a CO2e value. This provides vital data for both mandatory and voluntary reporting. Perhaps more importantly, it provides insight to help companies offset and reduce their environmental footprint and help combat climate change.

Why is carbon accounting important?

To avoid the worst impacts of climate change and maintain a habitable planet, scientists agree that the global temperature increase needs to be limited to 1.5°C above pre-industrial levels. To achieve this, as set out in the 2015 Paris Agreement, emissions need to be reduced by 45% by 2030 and reach net zero by 2050.

Many businesses recognise that they play a key role in reaching this target, and together with governments and individuals, are publicly committing to reducing their carbon emissions. Quantifying their carbon footprint is a vital first step in this process.

Five reasons why carbon accounting is good for business:

- Develop corporate sustainability: As the world moves to a low-carbon economy, taking steps to join this movement and reduce emissions is crucial to ensure a business remains resilient. Using the insight gained through carbon accounting, companies can work to reduce their footprint through changes to trade, production and working practices. Alternatively, they can buy carbon credits to offset carbon emissions that they cannot yet reduce.

- Stay compliant: Increasingly it’s becoming a legal obligation for public companies and large businesses to report their GHG emissions every year, with financial penalties for those who fail to comply. Carbon accounting is fast becoming an essential part of annual reports.

- Save time and money: Measuring GHG emissions is usually the first step in reducing them, which could lead to more efficient business operations and cost savings thanks to lower energy bills and more sustainable practices.

- Appeal to investors: Proactive, measurable climate action is becoming a factor for businesses who need to access capital. As financial institutions face increasing pressure from regulators to manage financial risk related to climate change, companies who demonstrate their commitment to climate action will be seen as lower-risk investments. In the future, capital could be more affordable for businesses that embrace carbon accounting.

- Build loyalty: Like investors, today’s customers, employees and stakeholders are putting growing pressure on organisations to be transparent about their carbon footprint and what they’re doing to reduce it. People want to align themselves with businesses whose values are the same as theirs, so taking action on climate change can create customer loyalty, help employee retention and give you a competitive advantage.

Identifying which carbon emissions to measure

What is a carbon credit?

A carbon credit represents the right to emit greenhouse gases equivalent to one tonne of carbon dioxide. Each credit can be traded as part of a cap-and-trade programme which aims to ensure that companies and countries reach the global CO2 emissions goals set out in the 2015 Paris Agreement.

Companies are given a set number of credits, usually by the relevant government, which reduce over time. If they’re able to operate with reduced emissions, they can sell any excess carbon credits. Companies that are finding it difficult to cut their emissions can buy excess carbon credits, allowing them to stay in business, but at a higher cost.

The system encourages companies to reduce their emissions by adopting greener, more sustainable practices to avoid paying out for carbon credits, and if possible, to sell their resulting carbon credits for extra revenue.

While there are a number of frameworks used by companies to measure carbon emissions, including those developed by the EPA, ISO and the Climate Registry, the most widely used is the Greenhouse Gas Protocol.

Launched in 2001, the GHG Protocol gives a global standard for how individual organisations can measure emissions and allows people to compare the performance of one business against another.

The protocol divides emissions into three groups, or scopes:

Scope 1: Direct emissions

Emissions from sources you own or control and that are directly related to your operations and processes, for example, emissions from boilers, machinery, fuel use, vehicles and those produced from manufacturing processes or fugitive emissions (such as methane emissions from oil and gas production).

Scope 2: Indirect emissions

These include emissions from sources that you purchase from third parties, such as electricity, gas, heating and lighting, air-conditioning/cooling and steam.

Scope 3: Indirect emissions from the rest of your value chain

These emissions occur as a result of your business activities and products, from sources not owned or controlled by you both upstream and downstream, including raw materials, waste, purchased goods or services, transport, commuting and business travel, leased assets, franchises, supplier emissions and emissions from use of your sold products. This also includes financed emissions – the emissions associated with a business’s investment and lending activities – and so are particularly relevant for financial institutions. Scope 3 emissions are usually much higher than those in Scope 1 or 2 and often the hardest to measure accurately.

Time boundaries also apply to each scope. Scopes 1 and 2 measure emissions from the reporting year, whereas Scope 3 can assess past, present and future emissions. For instance, if you sell cars, Scope 3 would try to estimate all the future emissions resulting from each car and allocate them to the year it was sold.

How are carbon emissions measured?

Once the various types of emissions have been assessed across the three scopes, the next step in carbon accounting is to estimate them. There are three commonly used methods:

The spend-based method: this multiplies the financial value of purchased goods or services by an emission factor – the volume of emissions produced per financial unit – to give an estimate of the emissions produced.

Though this is the simplest carbon accounting method, the emission factors used are based on industry-average GHG levels so may not be highly accurate. For instance, if you buy a dress, the spend-based approach uses its price, but won’t distinguish between a dress made of linen or polyester.

The activity-based method: uses data to determine how many units of a certain material or textile component a company has purchased. Going back to our dress, it uses the amount and type of material used to make the dress to calculate the carbon footprint, not just its price. Activity-based carbon accounting is more accurate, but the data can be harder to come by.

The hybrid method: recommended by the GHG Protocol, this combines the previous two methods. It estimates emissions following an activity-based approach and fills any gaps with a spend-based approach. It’s the most widely used and most practically accurate carbon calculation standard.

Carbon accounting in financial services

Every organisation needs to report on their Scope 3 emissions, including financed emissions, but for financial institutions this constitutes the major part of their business activities. This means that as lenders and financial institutions take steps to implement carbon accounting, they need to accurately report on GHG emitted from any organisation that they finance through credit products, investments or insurance. For instance, a bank financing a petrochemical company is likely to have a carbon footprint many times higher than a bank funding an offshore wind farm.

The Partnership for Carbon Accounting Financials (PCAF) has developed the Global GHG Accounting and Reporting Standard for measuring and reporting financed emissions in response to industry demand. This is widely accepted as the global standard for the calculation of financed emissions, allowing financial institutions across the world to consistently measure and declare the greenhouse gas (GHG) emissions resulting from their financial activities.

How financed emissions are measured varies depending on the type of financing offered by an institution. The PCAF guidance gives formulas for assessing the GHG emissions of varying asset types from listed equity and corporate bonds, to unlisted equity, project finance, commercial real estate, motor vehicle loans and sovereign debt. This means that any financial institution can measure and publish their financed emissions for every type of finance clearly and consistently. And much like the GHG Protocol allows consumers to compare brands, the PCAF system allows for comparison between lenders, making it easier to identify genuinely green investments.

Climate change increasingly poses one of the biggest long-term threats to investments.

Christiana Figueres, Executive Secretary of the United Nations Framework Convention on Climate Change, 2010-2016.

The challenges of carbon accounting

Despite the growing appetite for environmental accountability in all sectors, carbon accounting poses specific challenges for businesses, and for financial institutions in particular:

Incomplete data – carbon accounting relies on access to comprehensive, accurate data that can be traced back to its source and updated regularly to allow for comparison and benchmarking. Such data can be hard to source when calculating any Scope 3 emissions, but the PCAF acknowledges this as a fundamental challenge when calculating financed emissions.

Time and cost – many businesses rely on manual data collection and spreadsheets to calculate their emissions, which is labour intensive and expensive. Relying on manual labour also means the process is susceptible to human error and multiple inaccuracies.

Incompatible data sources – measuring emissions across the three scopes necessarily means capturing data from different parts of the business, from both internal and external sources. Such data is likely to be in an unstandardised format, making it difficult to benchmark and monitor, which then increases risk. These problems, common to all businesses, are likely to be multiplied across a global organisation.

Data blind spots – financial institutions with a commercial lending portfolio will see a significant portion of their Scope 3 emissions coming from SMEs, making accurate SME data key to effective financed-emissions reporting. However, in many cases lenders may not know which sector an SME customer operates in, or even have access to accurate contact details, which makes understanding their emissions status doubly difficult.

Low investment – a lack of understanding among some senior management can mean that carbon accounting is seen as a chore, rather than as an opportunity for the business to develop sustainably and potentially cut costs. This means that the process may not receive the investment of time or resources needed to harness its full potential.

The challenge for humanity doesn’t end with high-quality data – but it is certainly a vital cog in the greater endeavour of tackling climate change.

Scott Harrison, Director Market Engagement, Experian

How we can help: introducing Experian ESG Insight

If you’re a lender looking to embrace the potential of carbon accounting, you’ll need access to the highest quality data to measure GHG emissions for each of your asset classes. This means you’ll need trusted data on your SME customers’ environmental, social and governance (ESG) profiles, including detailed information on their GHG emissions.

The good news is that we’ve developed a simple tool to help lenders set credible financed emissions baselines. Based on our trusted nationwide business data, Experian ESG Insight provides an instant estimated ESG and GHG emissions profile on every SME in the UK, allowing you to calculate, manage and report on your downstream customer emissions levels accurately and at speed.

ESG Insight benefits at a glance:

- Get a more accurate view of your financed emissions quickly and easily for hassle-free legislative reporting.

- A reliable starting point from which to track your progress towards net zero.

- Pinpoint carbon hotspots in your portfolios so you can target your decarbonisation efforts to the right business at the right time.

- Enjoy greater visibility of your customers, enabling you to begin to build climate-related risks and opportunities into your operational credit decisioning.

Find out more about how ESG Insight can help your business. Or get in touch to talk with one of our team – we’ll be happy to help.

At the top of the graphic, there are a range of emissions: CO2, N20, CH4, PFCs, HFCs, NF3, and SF6.

There are then three stages: Upstream, Reporting Company, and Downstream.

Within Upstream:

- Scope 3: Indirect emissions from sources not owned or controlled by the company. This includes raw materials, waste, purchased good/services, transport and distribution, employee commuting, business travel, leased assets, and supplier emissions.

- Scope 2: Indirect emissions from third-party purchases. This includes electricity, steam, heating and lighting, air-conditioning, and cooling.

Within Reporting Company:

- Scope 1: Direct emissions from company activities. This includes combustion, machinery, fuel use, vehicles, manufacturing processes, fugitive emissions, and gas.

Within Downstream:

- Scope 3: Indirect emissions from sources not owned or controlled by the company. This includes use of sold good and services including financed emissions, transport and distribution, franchises, and leased assets.

The challenges of carbon accounting

- Incomplete data

- Time and cost

- Incompatible data sources

- Data blind spots

- Low investment