Ensuring decision-making processes are precise, agile, and speedy is crucial for FinTechs trying to respond quickly and effectively to market changes, particularly when faced with an uncertain socio-economic backdrop.

Alongside FStech, we conducted a survey to assess the ways in which FinTech companies are harnessing artificial intelligence (AI) and machine learning to optimise decision making, drive innovation, and support customers and clients through the cost-of-living crisis.

What’s covered in this report?

The results in this report provide a representative snapshot of the key challenges, strategies, and solutions for FinTechs as they look to use data, AI, and new technologies to keep up with competitors in an era of digital transformation and innovation.

Download the report nowCredit-related decisions

The majority of FinTech senior leaders believe that rolling out AI and ML is a priority when it comes to credit decisions.

Operating credit risk decisioning

The research shows that while the of majority organisations have plans to automate credit risk decisioning with AI and ML, they are struggling to get to roll out stage.

Automating decisions

The vast majority of respondents are either starting to roll out AI and ML to automate decisions, or have plans in place - with none of the respondents in the survey saying they don't use either technology for their credit decisions.

Innovation and future growth

Two fifths of FinTech leaders have highlighted data access and insight as a key priority when it comes to enabling innovation and future growth. It's clear that most companies are aware that data is crucial to their future growth, but many are struggling to effectively source and manage it.

Report highlights include:

Key drivers for rolling out technology

64% of respondents said meeting regulatory compliance standards is the top reason FinTechs are adopting automation, AI, and ML

Key barriers to automating credit decisioning

Over 60% of respondents found data availability to be a key barrier to automating credit decisioning.

Data-related challenges

The greatest data-related challenge for senior leaders - chosen by nearly six in ten respondents - is one of the most important processes associated with credit risk decisions - affordability checks.

Impact of cost-of-living crisis

Overall the results show that financial services companies are adapting their processes to improve services for their customers and alleviate the impact of rising inflation on consumers rather than retrenching and withdrawing key products and services.

A sneak peek into:

How are FinTechs using AI and machine learning to optimise decision making and support customers at a time of economic uncertainty?

1. Which of the following are current priority areas for your business when it comes to making credit-related decisions?

With the UK a hotspot for fraud, financial crime is on the rise, and fraudster methods are becoming increasingly sophisticated. It’s therefore no surprise that managing this kind of illicit activity when making credit-related decisions takes precedence for two thirds (66%) of FinTech professionals.

This result is echoed by the more than two-fifths (44%) of respondents who said that meeting regulatory standards was a priority. Arguably one of the most important compliance responsibilities for FinTechs is having the right checks, strategies, and technology in place to stop fraud and other criminal behaviour such as money laundering.

“The majority of FinTech senior leaders believe that rolling out AI and ML is a priority when it comes to credit decisions…”

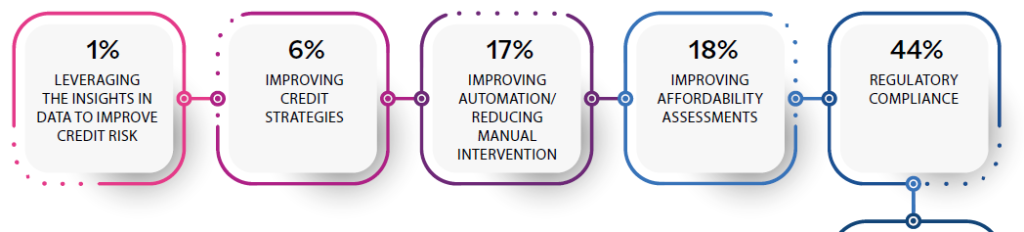

The survey reveals that the majority – 60% – of FinTech senior leaders believe that rolling out AI and ML is a priority when it comes to their credit decisions. The need for some organisations to boost existing systems and processes with technology is further highlighted by the 17% who said they want to improve automation or reduce manual intervention.

Fraud is now a greater and more costly threat than ever before and as the risk landscape continues to change, AI and ML are turned to more and more to help solve the challenges many FinTechs face.

Did you enjoy the read?

Download the report "How are FinTechs using AI and machine learning to optimise decision making and support customers at a time of economic uncertainty?"

We collaborated with FStech and surveyed 104 financial services professionals, across various business functions from a range of leading UK FinTechs. Find out how FinTech companies are harnessing AI and machine learning to optimise decision making, drive innovation, and support customers and clients through the cost-of-living crisis.