Identify opportunities to improve mortgage loyalty

Large numbers of mortgage customers each month are coming to the end of their existing mortgage deal

Are you doing enough to retain these customers? Do you know how your attrition rates and profile of lost business compare to your peers and industry averages? How does this vary between home movers and re-mortgages? And how can you ensure an effective pricing strategy without damaging overall margins?

With property transactions forecast to fall by 21% in 20231 and lending for house purchase mortgages predicted to fall 23%, now could be an ideal time for mortgage lenders to review their customer retention strategies to protect mortgage lending and retain customers.

96% of new borrowers since 20192 have chosen fixed term contracts with a shift towards 5-year fixes. 2023 is expected to see high values of refinancing on the back of new lending in 2021 driven by the Stamp Duty holiday1 with 1.8 million fixed rate mortgage deals are scheduled to end in 2023. Now is the time to review and assess your portfolio and identify the best opportunities for customer retention.

Since the introduction of procuration fees for product transfers, the rate of execution-only transfers is less than 50%. Whilst the retention procuration fees paid by lenders are typically less than those for new business, there are lenders who pay the same fee to brokers in both scenarios. There is debate, and of course differing views, about the future size and engagement of the broker channel as lenders look to improve their own digital processes; and whilst consensus is that brokers will remain an important element of the mortgage market, could their overall size begin to shrink?

With the size of the product transfer market, it is important to have a clear strategy for both intermediaries and direct customers. In this article we will explore some considerations in the direct channel including how organisations can evaluate the size and value of business that today they may be losing to competitors.

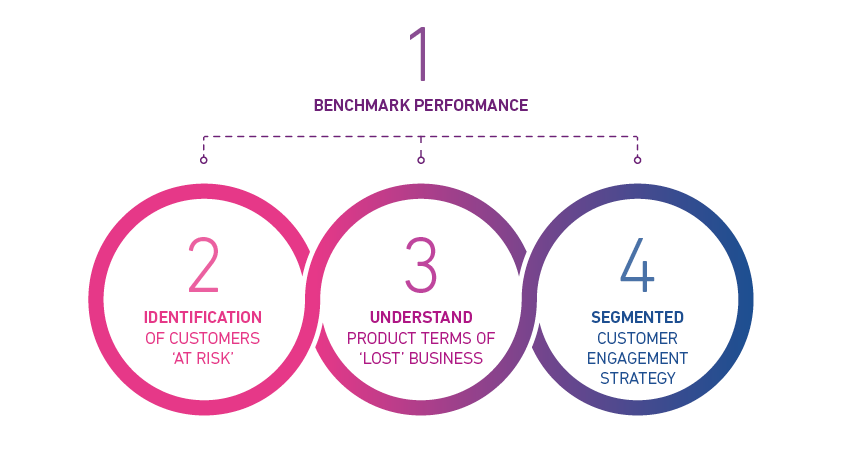

Benchmark performance

To allocate investment and resources effectively it is always important to understand the potential size of the opportunity, and consider measuring across multiple metrics, to secure funding and buy in from various areas of the business. Looking at closure rates across the industry and then the proportion of these closed accounts that end up with new mortgage lending with another provider, Experian’s insight shows large differences across the sector. Looking at the average rate for this metric across a 12-month period our insight shows a variation between “best” and “worst” in the order of a factor of 4.

Benchmarking through a third party with robust data across the mortgage industry will enable you to understand where your organisation sits on this range.

When considering the existing business that is moving their mortgage lending elsewhere and comparing this to the volume of new lending again shows notable variance across the industry. Looking once more at the two ends of the spectrum we see a variation in the order of a factor of 5.

To bring these figures to life, if an organisation with higher proportions of closed accounts taking a mortgage elsewhere could improve their rate to an average level, this could be comparable to around a 25% increase in new lending volumes.

Identification of customers ‘at risk’

Traditional risk and indebtedness measures can be used to forecast attrition with a good level of accuracy. Perhaps unsurprisingly, customers with the lowest levels of risk and highest levels of affordability show the highest levels of attrition. Organisations should ask themselves how can the accuracy of attrition models be improved? New modelling techniques may provide uplift against traditional models, but organisations shouldn’t overlook the breadth of internal data assets they will have available.

Non-traditional sources such as customer contact history and data captured during mobile application and website interactions could also be considered. A combination of predictive models and segmentation approaches will enable an organisation to tailor messaging, offers and pricing to the most appropriate customers at the best time. For example, looking at a combination of re-mortgage likelihoods, together with a propensity to switch provider, will give a greater level of granularity in customer engagement and pricing strategies.

Understand product terms of ‘lost business’

Detailed analysis of off-book data customers you’ve lost compared to customers who have kept their lending with you, either with no product movement or re-mortgaging, will help inform product and pricing strategies that can in turn improve retention rates.

For an organisation that also has, and maintains, the primary banking relationship, it will be possible to perform some rudimentary analysis with internal data to see the effect of the re-mortgage on monthly payments; but this is only one element, and in isolation could lead to false conclusions being drawn.

For organisations without the primary banking relationship, either because that is held elsewhere, or current accounts are not a product offering, understanding any change in product terms is not possible without the input of a third party.

Through the use of off-book data, an organisation will be able to uncover insights around product terms and subsequent behaviour of ‘lost’ customers. This information can be incredibly valuable when compared against your own risk, product and pricing strategies.

The list below provides examples of some of the analysis that can be achieved (please note these are high level examples and in no way an exhaustive list). These metrics can be produced for:

- Your portfolio

- A bespoke peer group

- The full mortgage market.*

*for providers contributing to CAIS data

Segmented customer engagement strategy

Consumer research3 has shown that for repeat buyers, their primary reasons for choosing a lender are:

- Rate

- Fees

- Existing relationships.

Understanding the product terms of lost business can help inform rate and fee structures to minimise attrition in key segments. Organisations providing multiple products have an opportunity to deepen existing customer relationships and benefit from the advantages this can bring.

Our research shows that around 50% of customers who move their mortgage lending have multiple non-mortgage accounts with their old lender.

For organisations where the depth of relationship isn’t as high, customer experience and engagement can become all the more important. Outside of a house move and other key events, the typical levels of interaction with a customer’s mortgage provider will be low. Organisations need to consider how to appropriately and efficiently build engagement levels with their customers so that when considering re-mortgaging, the existing lender is the first, and ideally only, port of call.

The organisations most likely to succeed will be the ones that combine the wealth of data available today with analytics and technology to drive highly tailored proactive retention strategies.

How can we help?

At Experian we have a long track record of working with organisations to help them qualitatively and quantitatively benchmark their performance across multiple metrics.

Our data assets and analytical capabilities in conjunction with our consulting experience can help organisations identify previously undiscovered insights and turn this insight into actionable business strategies.

Get in touch

Find out more about how we can help your business through data, analytics and consulting.

Let's talk[1] Mortgage lending to fall 15 per cent next year, returning to pre-pandemic levels, UK Finance

[2] How the Bank Rate affects mortgage rates, UK Finance

[3] Competing on customer experience in US mortgage, McKinsey & Company