Open Banking Data: The Ultimate Guide for BusinessExplore the basics of Open Banking, including how it works, its benefits, and practical tips for success.

Guide

Why does Open Banking matter?

Open Banking reached 10 million users[1] in July 2024, driven by Covid-19 pandemic adoption, with 57% of financial organisations implementing it. Businesses report cost and time savings, while customers benefit from faster credit responses, proactive financial support, and better decision-making.

Understanding Open Banking for business

Since its introduction in 2018, the OBIE[2] has overseen Open Banking regulation, enabling the financial services industry to undergo a stark transformation. In particular, innovation in business products and customer experiences have raised the bar, and the consumer expectations.

What is Open Banking?

Open banking is a secure system that allows banks and financial institutions to share financial data of consumers – where they explicitly consent – with authorised third-parties such as lenders and relevant businesses.

It uses consumer-consented data to build a connected banking system that benefits both financial institutions and consumers.

Businesses can access Open Banking services, like embedded finance solutions, with consent from their directors and account holders.

By having secure, standardised access to financial data — consented by the customers themselves — lenders can gain incredibly accurate insights into consumer behaviour, enabling them to personalise services and offers like never before.

How does Open Banking work?

Open banking is driven by Application Programming Interfaces (APIs), which are secure digital gateways for information to flow in real-time. APIs are sets of protocols that allow different software components to communicate with each other, sharing data seamlessly and securely.

A banking API enables the players involved in the ecosystem to interconnect and share data securely. Participants include:

- Consenting customers, including business customers and consumers

- Account providers (ASPSPs) which covers financial institutions like banks

- Third party service providers (TPPs) which refer to financial service providers like payment processors, budgeting apps and other fintechs

- Technical service providers (TSPs) connect ASPSPs with consumers and TPPs

The regulator is the final participant in the Open Banking ecosystem. Governed by its own set of rules, the regulators: set protocols for security, oversee each Open Banking standard and manage the actions of the other participants.

What type of data is shared?

Consumers can share various types of financial data through an Open Banking API in order to improve their financial experiences.

Some of the most common examples include:

Purpose | Data collection | Impact |

Affordability checks | Complete a mortgage fact-find prior to meeting with the customer | Significant time savings per customer and therefore cost savings on resources |

B2B lending | Automate the collection of financial data, even for less-established businesses whose lack of history may rule them out of traditional loan eligibility | Explore an untapped sector of the b2b lending market and acquire new customers |

Eligibility for social housing | Sharing of income data to signify benefits and social housing eligibility | Vulnerable customers benefit from financial inclusion opportunities |

Debt assessment by utilities companies | Assess whether customers can afford monthly energy bills alongside their debt repayment obligations and take instant payments | Provide informed repayment plans to prevent defaulting |

Invoice financing | Automatically calculate the most suitable amount for invoice financing and take over collections with consent-powered direct pay-by-bank payments | Minimise delinquency rates and speed up the collections process |

Gambling limits assessment | Income and outgoings transaction categorisation reporting to assess whether customers can afford to stake the amounts they wish, and make a direct open banking payment to their online betting account | Promote fair and responsible gambling and protect consumers from spending above their limits |

Current Account Switching Service | Enable banks to share financial account information like transaction history between themselves | Significantly reduce the time it takes to close one bank account, open another, and transfer funds between them |

Budgeting apps | Collect all income and expenditure from various sources into one place for automated budgeting solutions | Personalised and tailored budgeting advice based on real data for better-informed financial decisions |

Subscription finder | Automated finding of regular transaction payments to companies | Save money by cancelling subscriptions that the customer may have forgotten about |

Key takeaway

Companies can join the Open Banking ecosystem by defining themselves as participants, connecting through an API and following the regulations. Many new innovative financial services, such as subscription finders, have been created under these conditions.

Why do businesses and their customers use open banking?

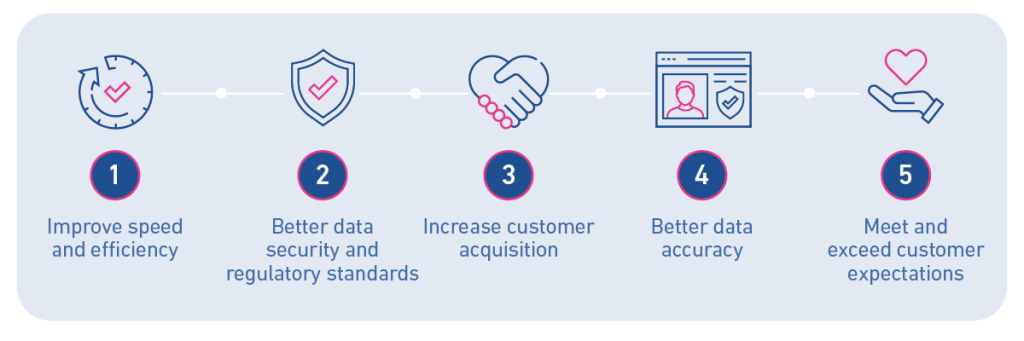

The high-level benefits of Open Banking are increased industry competition, driving better innovation and improving customer service. In both B2B and B2C environments, here’s why both businesses and their customers use open finance:

1. Improve speed and efficiency

Ever since Open Banking protocols were first announced, time savings were quickly perceived as the largest benefit. Interest in 2018 was because of the speed at which payments could be made, and the everyday customer was strongly focused on convenience.

Time is one of the biggest challenges for any business.

B2C efficiency improvements

In a B2C environment, the transformation of mortgage affordability checks gives time back to mortgage brokers and their customers. For example, you can ask your customer to share their credit summary data with you through Open Banking. This can automatically pre-populate into your fact-find, meaning that you get a good understanding of the customer’s financial situation before they walk through the door.

The technology could eliminate 30-40 minutes from the total customer journey, and mean that mortgage advisors are in a powerful position to have a more meaningful conversation. Instead of, ‘How much do you pay for your bills?’, you’re asking the customer to discuss their dream house and checking how they’re protecting their children.

B2B efficiency improvements

The time and efficiency benefits also apply in B2B settings. Thanks to a combination of transaction categorisation and management accountancy data, small business applicants undergo a much faster, automated loan application process.

When using Experian’s dedicated B2B Open Banking product, Commercial Acumen, for example, this data is automatically overlaid with trusted commercial credit bureau data. Loan application time is cut by up to 90% through faster rules-based decisioning, which can be automated thanks to the comprehensive view of the business’ financial health and lendability.

2. Data security and regulatory standards

A major benefit of the Open Banking ecosystem is the security of personal financial data.

Threats like the loss or theft of this customer data, data protection breaches and fraudulent transactions are concerning for customers and organisations alike. But the regulatory initiatives for Open Banking means that all participants must build safeguards and protection mechanisms into their protocols in order to prevent these threats from materialising.

Namely, the technical standards for customer account verification requires businesses to follow Strong Customer Authentication (SCA). Two of the following three methods of confirmation must be met, as a form of two-factor authentication, before the user is granted access to their account:

- Knowledge: credentials like a password or memorable answer

- Possession: a code sent to a known phone or email account

- Inherence: face ID or fingerprint authentication

Knowledge

Credentials like a password or memorable answer

Possession

A code sent to a known phone or email account

Inherence

Face ID or fingerprint authentication

Through careful operational decisions, participants are able to go beyond these standards and safeguard the reputation of Open Banking as a secure place for data.

For example, in 2024, 98% of companies were using cloud-based technology[3] rather than legacy systems. Cloud-based technology has proven to be flexible and versatile, with organisations able to continually enhance their platforms in order to respond to evolving security risks. In comparison with legacy systems, they are less vulnerable to security issues and can quickly be updated with the newest technology.

Reduced risk of fraud

Open Banking has a reduced risk of fraud by nature, due to its in-built identity verification checks. In a B2B setting, this means authenticating:

- The contact that you are dealing with actually exists and is not a bot

- The contact is associated with the business you are dealing with

- The contact has access to the right credentials for log-in into the business’ financial accounts

In the traditional business loan application process, one colleague may be responsible for initiating the loan application, another may be responsible for approving the request, and another for providing the financial statements – a process which leaves the door open for fraudsters at any of those touchpoints.

Instead, the Open Banking authentication process removes much of this risk during the B2B lending journey.

Further fraud indicators exist during the B2C Open Banking journey to reveal whether customers are deemed ‘high-risk’. For example, in order to receive a credit summary, a customer’s financial records must meet a minimum level of history and detail to ensure that the information provided is reliable. Without such factors, lenders would not receive a report at all, as the level of confidence within the data is below threshold.

Through Experian’s products, sanctions and identity verification checks can be performed in every Open Banking journey to provide an extra layer of security against fraud.

How to overcome skepticism from customers

While most businesses trust the security measures of Open Banking, customers may not. In fact, 60% of customers[4] still report that they don’t quite understand the concept of Open Banking.

People often err on the side of caution: for example a guarantor in a private rental agreement might wonder, “Why do you need so much information just to guarantee rent payments?”. However, companies require this data to fulfil risk assessment and due diligence obligations.

The solution to this scepticism is to educate customers on the secure nature of data sharing through Open Banking payments, and all of the relevant regulatory mechanisms that uphold this standard.

For example, when customers pay their council tax, there’s usually a disclaimer at the bottom which states that the data may be sold on, which many customers aren’t aware of.

On the other hand, any Open Banking protocol requires the customer to be armed with a full list of the data they are consenting to sharing. They are informed of the reason for access and usage, empowering customers with control. Even better, this consent is for one-time access, and expires after 90 days. This means that the customer receives the benefit of the financial product or service they need, without compromising by giving away more data than they need to.

Key takeaway

To fully embrace Open Banking, customers require a minimum level of digital knowledge. But in order to meet financial inclusivity standards, institutions must strive to prioritise those who are not yet digitally-literate. Demonstrating the value of services in exchange for the customer’s consent will be key moving forward.

3. Increase customer acquisition

One of the major incentives for Open Banking’s introduction was to increase market competition. By promoting innovation and levelling the playing field, it would be easier for a small fintech company to compete with the traditional banks to acquire customers.

This has materialised through three key trends:

- The decline of face-to-face banking interactions thanks to the Covid-19 pandemic, which has been at the core of several political debates, has accelerated the use of online banking

- Online finance services tend to include more touchpoints within the consumer journey, promoting a better customer experience

- Better customer experience leads to loyalty and recommendations, increasing customer acquisition and retention

The way that banks are spending their marketing budget is also changing, now focused on educating the remaining cohort of customers on the benefits and opportunities of Open Banking products.

On top of that, there has been a strong shift towards digital advertising channels, such as Youtube, which is less expensive than traditional TV advertising. Ultimately it reduces the overall costs of marketing at better conversion rates, and therefore provides cheaper customer acquisition.

4. Better data accuracy

Traditional means of assessing credit leave companies reliant on third parties such as Credit Reference Agencies (CRAs). But taking up to one month to update[5], it’s lenders in particular that could be making decisions based on outdated information.

Instead, Open Banking offers more detailed information – with the customer’s consent – on current and historical income and expenditure through statement data. This holistic view of transactional behaviour could provide a more complete picture of a customer’s financial status.

Open Banking improves the accuracy of data in three key ways:

- The data is more recent

- There is a larger sample size

- The data is more detailed

What are the impacts of recency, sample size and detail?

Data is accessed in real-time, meaning that a purchase from just five minutes ago is captured within the Open Banking information. For credit providers in particular, this means more confidence in lending decisions as an up-to-date view on a person’s income and expenditure is available. You’ll know immediately if regular income, like a salary, is missing and that the applicant’s position has changed because they have lost their job, for example. This decreases the risk around collections and defaults.

Open Banking provides access to a customer’s financial data from all streams, sources and frequencies. This paints a broader picture in comparison to CRA data, which typically comes from traditional sources. Having access to more streams increases accuracy because it helps to provide extra context to a customer’s complete financial situation.

Open Banking platforms also harness automatic categorisation of income and expenditure, into 186 different FCA-approved categories. With 95% accuracy, which is widely considered to be the best in industry, Experian’s Affordability Passport identifies behavioural trends and signs of financial vulnerability when assessed over time. Importantly, in comparison with CRA data where this analysis would have to be performed manually, the benefits include over 50% reduction in the time taken to source data and 75% reduction in the associated costs.

5. Meet and exceed customer expectations

‘Surprise and delight’ are the instructions that businesses typically receive in order to provide a better customer experience. However, as technology continues to evolve, expectations have been upgraded, and it’s now harder to impress.

Fortunately, Open Banking provides financial institutions and fintechs with a way to not only support their customers, but proactively make personalised product offers based on previous spending.

We’re constantly told by lenders that small businesses tend to come and ask for finance right at the last minute. Sometimes, it gets to the 30th of the month and businesses realise that they’re short on cash flow and can’t pay their staff, for example. They need a quick solution. That’s where Open Banking can really speed up the entire loan process and provide access to a broader range of products. Through automatic eligibility criteria businesses get access to embedded finance solutions much quicker than they could through traditional methods.

Imagine this: a business director applies for a short-term loan at a high interest rate because they are not aware of any other options.

However, by using Open Banking, you can instantly evaluate how well the business is running and see which products the business is eligible for. This leads to the offer of invoice financing, which has comparatively lower fees than the loan. With access to a better-suited financial product that the customer didn’t previously realise existed, they are delighted with your service, and easily retained for further banking.

How to apply Open Banking effectively: Use Cases

From credit brokers looking to optimise the loan application process to private landlords needing to verify guarantors, the use cases for Open Banking are only limited by your imagination.

In a B2C scenario, Experian’s Affordability Passport is the Open Banking provider that can help you achieve these results. The Affordability Passport covers products for:

- Open Banking

- Identity Verification

- Credit Summary

- PEPs and Sanctions

In each use case, you’ll learn how to get the data you need and how to maximise the benefits using the Affordability Passport.

From a B2B perspective, the Commercial Acumen product comes into play. It categorises income into 12 categories and expenditure into 35 key groups, providing a clear overview of a business’ finances.

Significantly reducing the need for manual documentation, Commercial Acumen works with secure APIs and real-time transaction monitoring to ensure the integrity of financial data, and detect fraud.

Mortgage affordability

Problem

Mortgage affordability, in its traditional state, is a slow and risky process. With potentially outdated information feeding the risk models, firms are in danger of making ill-informed lending decisions which increase the chances of defaults.

Moreover, with applicants biased towards a specific outcome (loan approval), they could become tempted to skew the self-reported data in their favour. Therefore, mortgage brokers and lenders require a more accurate channel of information.

Solution

Fortunately, Open Banking data comes straight from the source; the bank accounts themselves. Plus, the Affordability Passport provides the opportunity to feed this data into your fact-find automatically, automate credit decisions and assess product suitability through real-time data collection and analysis.

It works by blending together the credit summary, ID verification, PEPs and Sanctions and Open Banking products under the Affordability Passport umbrella. With a more detailed overview of the financial picture, you can account for BNPL payments or salary advances, for example. This leads to a more accurate affordability assessment.

Key takeaway

As a broker, you can manage the applicant’s risk profile, make recommendations on mortgage products, and therefore place business more effectively, and in turn, improve the quality of a customer’s experience. The outcome is that customers will be able to access credit based on a more detailed understanding of their ability to repay the loan.

Social housing and utilities

Problem

Today, many Housing Associations undertake their own affordability assessments using self-declared income and expenditure forms. However, this manual process takes time from both the prospective tenant and the assessor, especially with the reliance on external calculators to understand benefits positions and complex spreadsheets for affordability modelling.

In situations where applicants are financially vulnerable, they simply can’t wait.

Solution

Open Banking enables a prospective tenant or customer to consent to share up to 12-months of their bank account transactions, which the Affordability Passport can automatically categorise into a standard financial statement with accuracy, and without hours of manual analysis. The process is convenient, secure and driven by consumer consent.

With the bank statement we can identify which FCA category each transaction belongs to, such as essential expenditure or discretionary spending like dining out. This insight helps advisors distinguish between fixed commitments and expenses that can be adjusted for affordability. It brings the finances to life.

Key takeaway

Promote financial inclusion when you quickly and efficiently determine eligibility for social housing. Support those in financially vulnerable situations to consolidate debt and access benefits that they may be entitled to.

Collections: promoting financial inclusivity

Problem

Defaulting on a loan is incredibly stressful[6] for the average consumer

But lenders also suffer, since traditional methods provide no way of getting a heads up when things are trending in the wrong direction. Lenders typically learn of defaults only after the customer has fallen behind, which limits recovery options and could potentially lead to a cascade of non-payments.

With financial instability growing through the cost-of-living crisis and many consumers already overburdened, it’s becoming increasingly important for lenders to step in before defaults occur.

Solution

Open Banking works in the pre-delinquency process too. By collecting the data digitally, the customer is saved from the stress of chatting with an agent, which is a process that many tend to avoid. This streamlined data capture can automatically inform outcomes to the consumer, tailored to their individual needs, for example, affordable payment options.

Affordability Passport makes this possible through a combination of the credit summary and Open Banking products.

Recently, a domestic water supplier improved its support of vulnerable customers through this combination. Replacing the need for customers to supply their own bank statements for assessment, a process that took weeks, the water supplier now uses Open Banking data to let customers know if they are eligible for social funding tariffs. In some cases, where the customer remained on the phone, they could immediately take advantage of this reduced tariff.

Alongside a reduction in delinquency rates, lenders have reported that the mere mention of using Open Banking in the collections process has led to improved kept rates as consumers sense that lenders mean business with their financial inclusivity promises!

Key takeaway

With the customer’s consent, collect data digitally to eliminate the need for stressful money conversations and support customers to take advantage of social funding tariffs. Use Open Banking data to prevent delinquency and ease the collections process.

Business invoice financing

Problem

With 99% of UK businesses classed as ‘small businesses’, cash flow is one of the most important factors to ensuring their success.

But where there is little to no history of finance, these companies are often left out of the lending conversation. Additionally, small businesses don’t typically have the upfront capital to manage big purchases that would ultimately grow long-term profitability, such as buying new machinery.

Solution

With consent, Open Banking technology enables B2B lenders to work access categorised transactional data, Business Information Bureau information and identification data.

Because small businesses may be excluded from traditional financing, the addition of Open Banking data makes a big impact. It helps to level the playing field for finance access, because the increased availability of data can better illustrate a business’ financial health.

Imagine removing the need to manually assess bank statements line by line. Instead, Open Banking enables an instant evaluation of:

- What is the income?

- What is the expenditure?

- What expenditure could be classified as negative?

- Are there any foreign currency transactions for a business only operating in one location?

- Is there a lot of cash being taken out of the business rather than bank transfers?

This instant assessment can reduce business loan application time by up to 90% and 40% cost reductions compared to the manual gathering of this data.

Not to mention less paperwork for the lender.

Experian’s B2B Open Banking product, Commercial Acumen, works to power multiple use cases across the lifecycle like this one, from originations through to collections. This creates better SME interactions and services to support them.

Key takeaway

Access untapped sectors of the B2B lending market by lending with confidence through reliable, broad financial data, even for small and less-established businesses.

How can Experian help?

Established for over 25 years, the reputation of Experian can give you the security and reassure customers that the data they’re sharing will be kept in a safe environment, including the most up-to-date verification methods like biometrics and two-factor authentication.

With best in class fraud indicators against competitors and our signature triple-testing process, you can rest assured that your data-sharing pathways are tried and tested. Access dedicated product consultants, who can guide you through the user documentation and API planning process to onboard quickly, and let your customers enjoy a seamless and secure data sharing experience.

See the Affordability Passport yourself, or try Commercial Acumen.

[1] Open banking marks major milestone of 10 million users, Open Banking

[2] Regulatory, Open Banking

[3] How Many Companies Use Cloud Computing in 2024? [10 Statistics and Insights], Edge Delta

[4] Five years on and 60% of consumers still don’t understand what Open Banking is, NTT Data

[5] How Often Is a Credit Report Updated?, Experian

[6] Always on your mind, Money and Mental Health Policy Institute