Three methodologies for assessing commercial affordability

Assessing commercial affordability can be a complex task

Using reliable and up-to-date data will help give you the clearest picture of affordability. In this blog, we will discuss three key ways to assess commercial affordability.

To be able to understand if a business can service its debts and to automate the assessment of affordability, then using the correct data is critical. Getting this information, however– especially up-to date data – is not always straightforward.

For example, non-limited businesses don’t provide profit and loss (P&L) data. Small limited companies (with a turnover of less than £10.2M) also no longer need to file this information. Moreover, where this information is available, it is typically between 10 and 22 months out of date. In this context, lenders need to look at more effective ways to assess affordability.

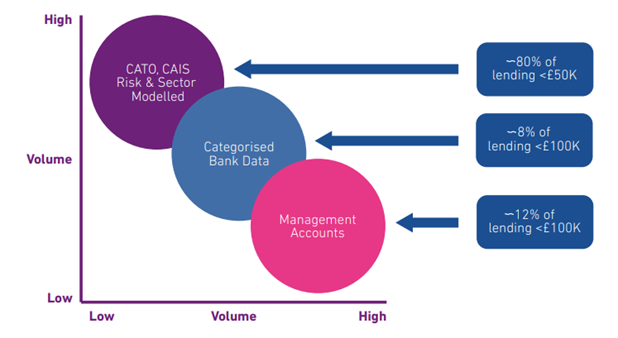

There are three main alternative approaches for assessing loan affordability for simple- and medium-complex businesses under these circumstances. These are:

- Use of current account turnover (CATO) and commercial credit account information sharing (CAIS) credit data along with typical business sector margins – typically for lending under £100K but predominantly sub £50K.

- Use of categorised bank account data to arrive at a pseudo profit & loss report for the business.

- Use of management accounts data including financial cash flow forecasts to gain an in-depth view of the business, its long-term health and future expectations.

The choice of which methodology to use is often a question of judgement and balance. This is because each of these approaches to assessing loan affordability either has its own regulatory framework to enable access to the data, or requirements for specific consent and credential-based access to be considered. These impose different levels of friction and complexity on the customer journey. Lenders need to balance the requirement for documentation and/or bureau data demands made on the SME, with the level of risk and then make a judgement about the value that the data will bring, compared to the costs associated with getting it.

Summary of approaches:

Method | Typical limits | Retrospective analysis | Access | Regulatory |

CATO & CAIS | Up to £50K | Yes | Via CRA Reports | SCOR & CCDS (membership) |

Categorised bank data | Up to £150K | No (except for banks) | Customer consent | Open Banking Regs |

Management accounts | Any amount | No | Customer consent | N/A |

We can see how often these approaches could be used by creating a graph which overlays the number of applications by the size of borrowing (i.e. all products on Commercial CAIS) over the last 5 years (excluding Bounce Back Loans seen during Covid-19). Please note that these figures will also be determined by organisational risk policies and lending criteria.

As part of the customer journey, potentially all approaches could be used to assess affordability. The judgement about which one (or which ones), to choose depends on various factors such as:

- The risk associated with a particular customer

- The availability of data

- The quantum of borrowing

- And the type of loan product that is being considered.

In specific cases – such as pre-assessed lending/advertising limits in banking and eligibility journeys elsewhere – CATO/CAIS is a methodology that can be used without creating much friction. In practice, this approach can often be used to facilitate both a limit that customers can borrow up to under a simple journey, through to higher limit which is ‘subject to’ additional checks and potential conditions on borrowing (such as collateral requirements, for example).

Displaying ‘subject to’ limits is important so that a customer is aware of what they could potentially borrow. If a customer sees an initial limit for £50,000 (based on what they can borrow immediately using bureau data including CATO/CAIS) but require more, they may be under the impression that the organisation won’t help them. Without using the all-important phrase ‘subject to’, they may, therefore, simply decide to look elsewhere.

One consideration that does need to be overlaid on top of affordability is sustainability and ensuring a business can continue to pay in the future. The CATO history can help here by showing if the business has a stable or growing income as opposed to declining income and worsening balance. With CAIS we can see the trend in debt and payments. Combining these measures on the track record of the business a view can be formed on the future stability or growth of the business to provide a level of comfort on its future capability to afford the facility.

How can we help?

We help lenders to achieve a “full picture” view of affordability by sourcing and analysing CAIS, CATO, Open Banking data, macro-economic forecasts and a range of other relevant data sources, subject to the size and scale of the facility being requested, and level of associated risk.

As well as bringing together these key data sources, we use a categorisation engine to provide granular commercial affordability assessments based on a broad span of income and expenditure categories.

Our economic forecasts take account of the array of complex factors impacting commercial affordability from fluctuating interest rates, energy prices and inflation, to market variables and consumer confidence. In doing so, we can help you assess a business’ ability to pay throughout their facility lifecycle and help minimise risk to your portfolio.