The Total Economic Impact™ of our Ascend platform

Download the complete study to explore the business impact of advanced analytics and automation in decisioning.

Download the studyDownload the study

To help organisations understand the financial impact of adopting Experian Ascend Platform™, Experian commissioned Forrester Consulting to conduct a Total Economic Impact™ study.

The study is based on in-depth interviews with decision-makers across the US, UK, Brazil, and South Africa who have experience using the Experian Ascend Platform.

The insights were consolidated into a composite lending institution, representing a business processing 250,000 loan applications, amounting to $312.5 million in loan originations annually.

The study provides a clear framework for evaluating potential return on investment (ROI), cost savings, and business growth enabled by the platform.

Download the study today to gain the critical knowledge and resources your organisation needs to stay ahead with automation and advanced analytics.

Forrester shares findings from its Total Economic Impact™ (TEI) study

Organisations face growing pressure to make faster, more consistent decisions while operating across fragmented data, legacy systems, and increasing regulatory complexity.

In this video, Forrester shares findings from its Total Economic Impact™ (TEI) study on the Experian Ascend Platform, showing how a single, secure decision intelligence platform helps organisations simplify operations, connect data and analytics, and scale decisioning with confidence.

Watch to see how Ascend delivers measurable outcomes, including strong ROI and rapid payback, while enabling organisations to modernise decisioning, improve efficiency, and respond more effectively to change.

Customer success snapshots

What was the real-world business outcome?

A sneak peek into:

The Forrester Total Economic Impact™ Study

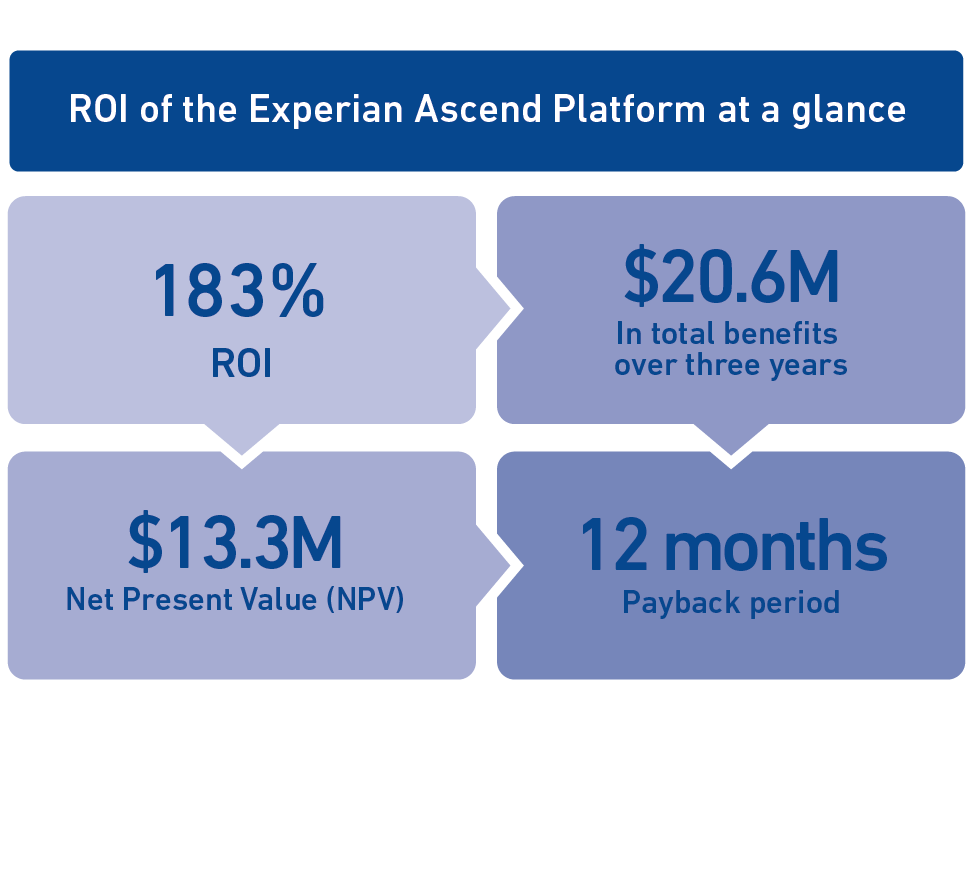

Key findings: The measurable impact of the Experian Ascend Platform

Financial Return

- 183% ROI

- Payback in just 12 months

- 20% reduction in default costs, mitigating financial risk

Business Growth

- 5% year-over-year in new revenue from additional loan applications

- 12% improvement in approval rates, enabling more responsible lending

Decisioning Efficiency

- 67% efficiency gains in credit decisioning, streamlining operations and reducing costs

Experian Ascend Platform is driving revenue because more business is being accepted on an automated basis. It’s taking the decision away from underwriters — making decisioning more consistent — and we are seeing less revenue erosion through successful fraud reporting.

Credit Manager, Car Leasing

Want to evaluate the potential impact for your organisation?

Download the Forrester Total Economic Impact™ Study in full

Forrester Consulting conducted this study independently, commissioned by Experian, to provide organisations with an objective, data-driven analysis of the financial impact of the Experian Ascend Platform.