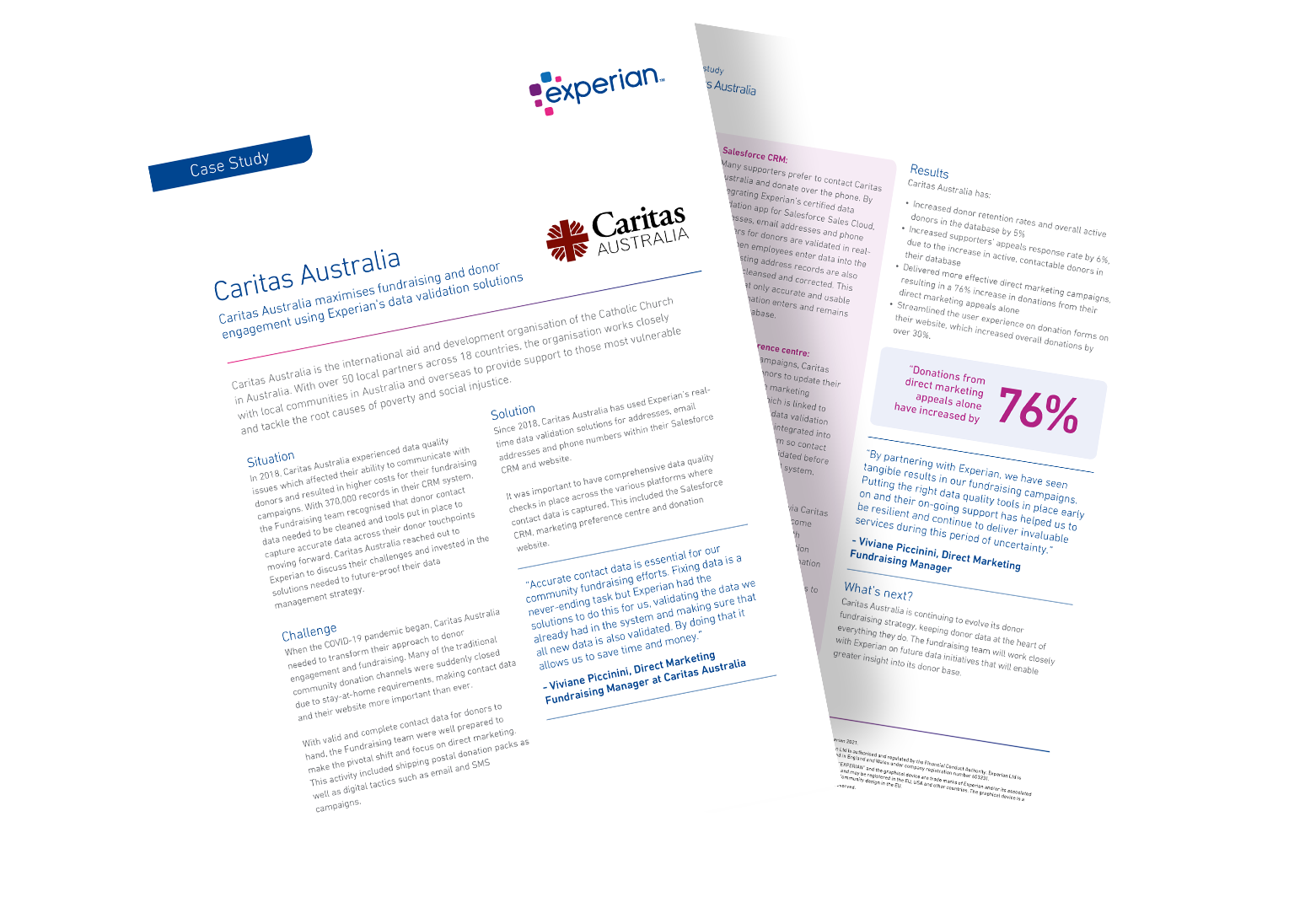

Overview: Caritas Australia maximises fundraising and donor engagement

Learn how Caritas Australia increased donor retention rates and active donors in the database by 5%

Caritas Australia experienced data quality issues which affected their ability to communicate with donors and resulted in higher costs for their fundraising campaigns.

With 370,000 records in their Salesforce CRM, the Fundraising Team recognised that donor contact data needed to be cleaned and tools put in place to capture accurate data across their donor touchpoints moving forward.

Challenge overview

When the Covid-19 pandemic began, Caritas Australia needed to transform their approach to donor engagement and fundraising.

Many of the traditional community donation channels were suddenly closed due to stay-at-home requirements, making contact data and their website more important than ever. With valid and complete contact data for donors to hand, the Fundraising Team were well prepared to make the pivotal shift and focus on direct marketing.

This activity included shipping postal donation packs as well as digital tactics such as email and SMS campaigns.

- Transform donor engagement after stay-at-home Covid-19 requirements closed traditional channels

- Communicate with donors more effectively to reduce overall costs of fundraising campaigns

- Shift focus to direct marketing using valid and complete donor contact data

Caritas Australia is the international aid and development organisation of the Catholic Church in Australia. With over 50 local partners across 18 countries, the organisation works closely with local communities in Australia and overseas to provide support to those most vulnerable and tackle the root causes of poverty and social injustice.

| Industry: | Not for Profit |

| Number of employees: | 200+ |

| Number of partners: | 50+ |

Solution overview

Caritas Australia reached out to Experian to discuss their challenges and invested in Data Validation for Salesforce to future-proof their data management strategy.

Since 2018, Caritas Australia has used Experian’s real-time data validation solutions for addresses, email addresses and phone numbers within their Salesforce CRM and website.

It was important to have comprehensive data quality checks in place across the various platforms where contact data is captured. This included the Salesforce CRM, marketing preference centre and donation website.

- Increased donor retention rates and overall active donors in the database by 5%

- Increased supporters' appeals response rate by 6%

- Increased direct marketing campaigns, resulting in a 76% increase in donations

Related Products

We have solutions we can tailor for your business needs

Speak to an expert