Data can transform your approach to detecting and preventing financial crime

By identifying the characteristics of money launderers and fraudsters, creating adverse markers, and improving transaction monitoring, businesses can protect themselves, and the economy, from financial crime.

We’ve been working to understand the behaviour of money launderers and how they use UK companies to commit their crimes.

Through using a blend of data sources, we’ve identified the traits of a money launderer and what actions could be cause for suspicion.

Characteristics of money launderers

We have identified key characteristics of money launderers, how they behave and patterns of suspicious behaviours.

Adverse markers

We have developed over 50 adverse markers to help businesses identify suspicious activity.

Transaction monitoring

What are the patterns in transactions which could indicate money laundering?

In this white paper, we cover:

How to recognise a money launderer

What are their key characteristics?

How can transaction monitoring help

What are the current challenges in transactional monitoring?

True financial crime stories

Where have we detected suspicious behaviour through data?

What's next for fincrime prevention

Using the latest innovations in data and analytics to hinder financial criminals.

A sneak peek into...

Helping to drive financial crime out of the UK economy

Adverse Markers – Warning signs to look out for

Leveraging this understanding of money launderers’ characteristics, we have catalogued over 50 adverse markers that can help businesses identify concerning behaviours. From multiple directors in different or high-risk jurisdictions to marked increases in cash inflow and outflow, the markers alert us to potentially suspicious activity. The more markers, the greater the likelihood of criminal activity. We have recently completed some analysis on the adverse marker population, comparing it to the general business population.

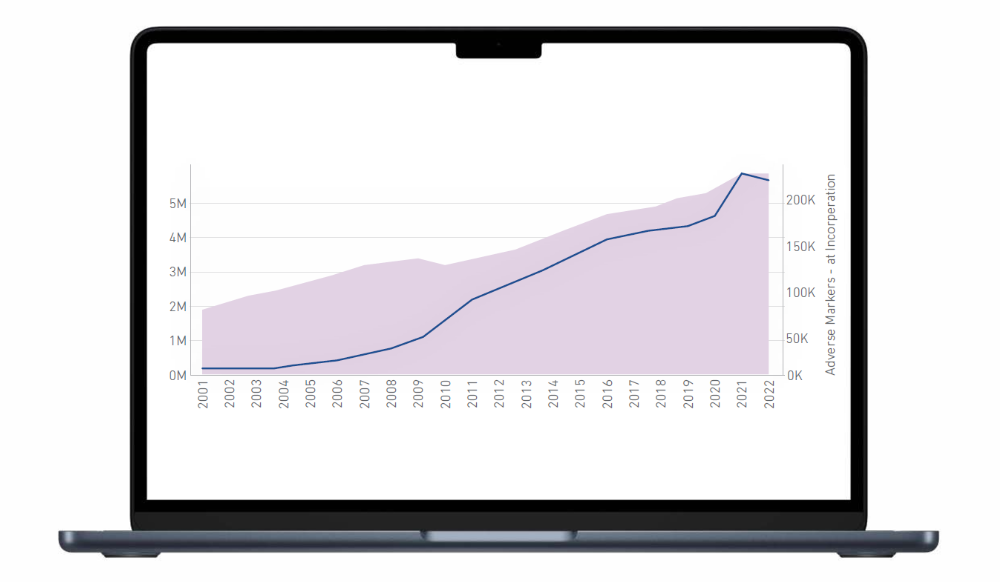

The graph shown gives striking evidence of how adverse markers can flag questionable behaviour, even at a macro level. The shaded area represents the growth of the UK business universe between 2001 and 2022. The blue line illustrates the adverse marker population; those businesses exhibiting one or more adverse markers.

While we can see the adverse marker population is growing at a faster rate than the UK business universe, there is a particularly marked increase in growth from 2020 to 2021. At a time when the government was offering unprecedented support to businesses (due to Covid), and when it had been reported that fraud in government-backed schemes was rife, we see an exponential increase in the adverse marker population.

Did you enjoy the read?

Download the full report

To find out more about identifying money launders and how transaction monitoring may help, download our report.