The Economic Crime and Corporate Transparency ActAre you failing to prevent fraud?

Guide

The Economic Crime and Corporate Transparency Act (ECCTA) is foundational in the fight against economic crime and was introduced in the UK at the end of 2023. The Act aims to help businesses avoid falling victim to things like money laundering and fraud, by enabling and encouraging rapid cross-sector data sharing.

Centred around enhancing corporate transparency, ECCTA allows industries and organisations to share information and insights into criminal activities and suspicious behaviour. By allowing this transparency, businesses are now in a better position to prevent fraud and financial crime.

ECCTA hopes to cut crime and protect would-be victims by driving a culture-change of improved fraud prevention across companies, and holding organisations accountable should they profit from their employees’ fraudulent activities.

Read on to better understand ECCTA; uncover its importance for businesses, the government, and public; and how to avoid the costs that come from failing to prevent economic crime.

How does the Economic Crime and Corporate Transparency Act work?

The Act has three objectives:

- Prevent fraudsters from using companies and corporate entities to commit crimes that impact the UK’s economy.

- Strengthen the UK’s response to economic crime.

- Support enterprise by enabling Companies House to improve the reliability of its data that in turn better informs businesses ahead of transactions and lending decisions.

Essentially, the ECCTA combines all of the necessary standards and checks, such as Anti-Money Laundering (AML), Know Your Business (KYB), and Know Your Customer (KYC), in order to create a complete, overarching picture of a customer’s activity and fraud risk profile.

Information and data you’ll be able to find includes:

Customer Due Diligence

This helps organisations verify the identity of customers and better understand their business methods and needs.

Customer Transaction Monitoring

By keeping a close eye on transactions, companies can more accurately detect unusual or suspicious patterns and activities that could cause red flags.

Suspicious Activity Reporting (SAR)

SAR is essential to the detection of fraud and money laundering as it flags activity that could be a cause for concern, potentially leading to criminal activity.

Current Account Turnover data

Having what is considered ‘normal’ account activity on record helps to spot when things seem unusual.

Multi-source data corroboration

This helps to validate that customers are who they say they are, and present themselves consistently across various data sources.

Key takeaway

By acting as a repository of information the ECCTA helps organisations more easily identify suspicious customer behaviours, spot trends and anomalies, and uncover risks ahead of going into business with them.

What are the advantages of the Economic Crime and Corporate Transparency Act?

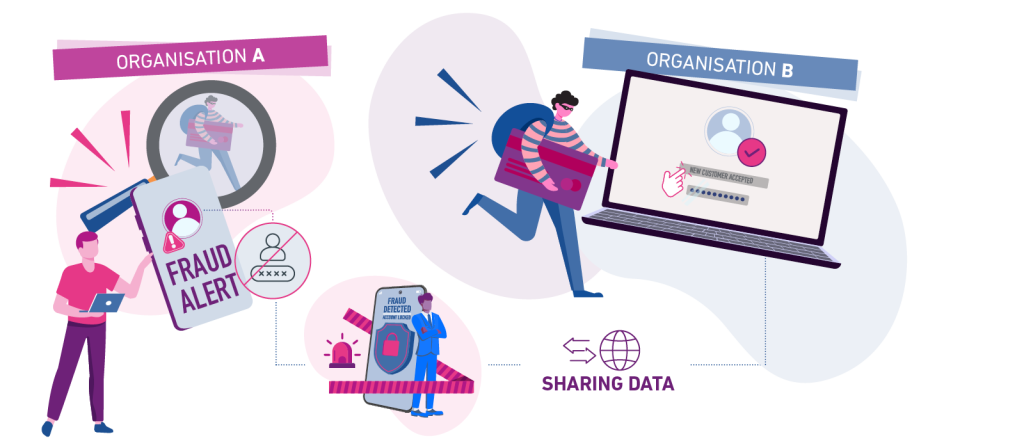

By combining and sharing data from both fraud and anti-money laundering (AML) defences, organisations can more easily join the dots between potentially suspicious behaviour.

In a real-life context this could mean that should a bank decide to end a relationship with a customer due to financial crime concerns, that bank can now share the decision with other banks the customer in question may apply to.

ECCTA is good for businesses of all sizes, across every industry. However, SMEs in particular can often fall victim to fraud owing to their size, so will benefit from greater protection. Put simply, the Act enables company-to-company and sector-to-sector data sharing, with advantages such as:

Creating a holistic approach

By combining fraud and AML risk defences, organisations create a network of understanding about the potential risks of a customer. Instead of siloed information that can lead businesses to be kept in the dark about potentially risky behaviour, a collaborative approach leads to better, more comprehensive understanding across different departments, companies, and sectors.

Ensuring efficiency and cost-effectiveness

Layering fraud and AML defences can mean using resources and budgets more efficiently, as it can help to streamline processes and reduce the need to double up on work efforts. For example, instead of multiple data analytic tools and monitoring systems, one programme could be linked and repurposed so it can be used for fraud detection as well as money laundering.

Providing enhanced risk management

By combining fraud and AML defences, alongside other corroborative data, organisations can create a consolidated single customer view of financial crime risks. Mapping everything out in a single place will make it easier to spot any potential overlaps and dependencies on a variety of illicit activities.

Which industries and organisations should comply with the Economic Crime and Corporate Transparency Act?

ECCTA applies to all industries and organisations, including charities and public bodies. Of course some will be more at risk than others – such as large corporates or financial institutions – but it is everybody’s responsibility to adhere to the Act.

To comply with ECCTA, businesses will need to:

- Disclose more detailed information about beneficial owners. This enhanced transparency prevents shell companies from being used for illegal activities.

- Conduct detailed due diligence on all vendors and partners to increase their checks on money laundering and financial fraud.

- Improve financial reporting to ensure all records are up to date and accurate.

What are the implications of not following the Economic Crime and Corporate Transparency Act?

What is Failure to Prevent Fraud?

“Failure to prevent fraud” is a corporate criminal offence, introduced under the UK’s Economic Crime and Corporate Transparency Act 2023, which holds organisations criminally liable if an employee or associated person commits fraud and the organisation did not have reasonable procedures in place to prevent it. This liability applies even if senior management was unaware of the fraud.

Not adhering to ECCTA can be disastrous for the finances and reputation of organisations and industries and, in extreme circumstances, could lead to prosecution. So much so, the government has created a new failure to prevent fraud offence[1] which holds companies to account if they profit from fraudulent activities committed by their employees.

Under the new offence, a company will be liable when specified fraudulent activity is committed by an employee, and the company did not have a reasonable fraud prevention process in place. This has made prevention measures more important now than ever before.

Using the ECCTA alongside FinCrime prevention methods

Having a robust fraud prevention process in place is key to avoiding the nightmare of being a victim of economic crime. Below are some of the key ways your business can bolster FinCrime prevention measures and adhere to the ECCTA.

Strengthen collaboration and information sharing

Creating more efficient information sharing and collaboration between businesses, internal teams, law enforcement agencies, and regulatory bodies is vital. So much so that we are establishing a Fin-Crime Bureau to better share intelligence, suspicious activity reports, and relevant data to facilitate more effective detection and prevention of financial crime.

Enhance Due Diligence and KYC procedures

Banks and financial institutions have to regularly review and enhance their customer due diligence and Know Your Customer (KYC) procedures. However, this is good practice for all organisations, no matter the sector. Think about implementing advanced identity verification technologies, leveraging data analytics for risk assessments, and conducting ongoing monitoring to detect and mitigate suspicious activities.

Invest in advanced technologies

Artificial intelligence (AI) and machine learning is no longer a nice-to-have for organisations to experiment with, it’s a necessity. Fraudsters and criminals are using AI to commit more sophisticated financial crimes, which means businesses should invest in cutting-edge technologies to fight back. Detection and prevention can both be improved with machine learning.

Provide comprehensive employee training and awareness

By ensuring that all employees are fully aware and trained up on all things financial crime, from emerging risks to evolving regulatory requirements, is essential. Creating a culture of vigilance and compliance can lead to earlier detection and overall prevention of things like money laundering and fraud.

Continually monitoring and risk assessment

When it comes to financial crime monitoring and risk assessments, a proactive approach is the best approach. This means undertaking regular risk assessments to spot vulnerabilities and implementing robust monitoring systems that can flag emerging trends or unusual patterns that could mean a financial crime is taking place. As well as this, regular audits and internal process reviews can help you identify and resolve any weaknesses in your systems.

Collaborate with regulators and industry peers

By actively engaging with regulatory authorities, industry associations, financial institutions, and organisations, you can better understand the best practices used elsewhere and share intelligence with the overall goal of combating financial crime.

Strengthen governance and oversight

Ensuring robust governance structures is a critical step when ensuring compliance and deterring financial crime. By creating independent and comprehensive compliance functions, with clear reporting lines to senior management and the board of directors, organisations can better identify areas for improvement and ensure adherence to regulations.

Let us help

Regulatory guidelines suggest getting external reviews: our interim advisory consultations can help you do this cost-effectively.

If you feel a little unsure on where to start with financial crime prevention and the ECCTA, we can help. Our expert team has multiple resources and solutions to help you join the dots between your different fraud teams and measures in order to create robust and compliant fraud measures.

Related products