According to Cifas[1], identity fraud in the UK increased by 22% in 2021 compared to the previous year, with 90% of fraud incidents originating online. Additionally, EUROPOL’s Internet Organised Crime Assessment (IOCTA) for 2021[2] predicts that cybercriminals will continue to innovate and capitalise on new opportunities to defraud organisations and individuals, further increasing negative impacts in the coming months and years.

Within the increasingly complex fraud landscape, Application Push Payment (APP) fraud is a particular concern for organisations and consumers. This kind of fraud involves fraudsters convincing consumers to willingly transfer money to them (usually posing as employees of organisations such as banks or construction companies). And, based on research from UK Finance[3], APP fraud cost UK banks and their customers £456 million in 2019 – up by more than £100 million a year earlier.

With all types of fraud on the increase, it’s no surprise that fraud detection and prevention is top of mind for more than 70% of organisations. The questions they need to know are: what can they do to prevent fraud in general – and APP fraud in particular? And which technologies and solutions do consumers trust and prefer when it comes to keeping their identities and accounts safe?

The impact of behavioural biometrics

With behavioural biometrics, it becomes possible to identify and authenticate consumers based on how they interact with their devices and apps. For example, some solutions enable banks and other organisations to analyse customers’ speech or understand how fast they type; others look at how they sign their name, or even the pressure they normally apply to the touch screens of their mobile devices. One emerging technology even makes it possible to recognise individual customers based on the unique way they hold their mobile phone.

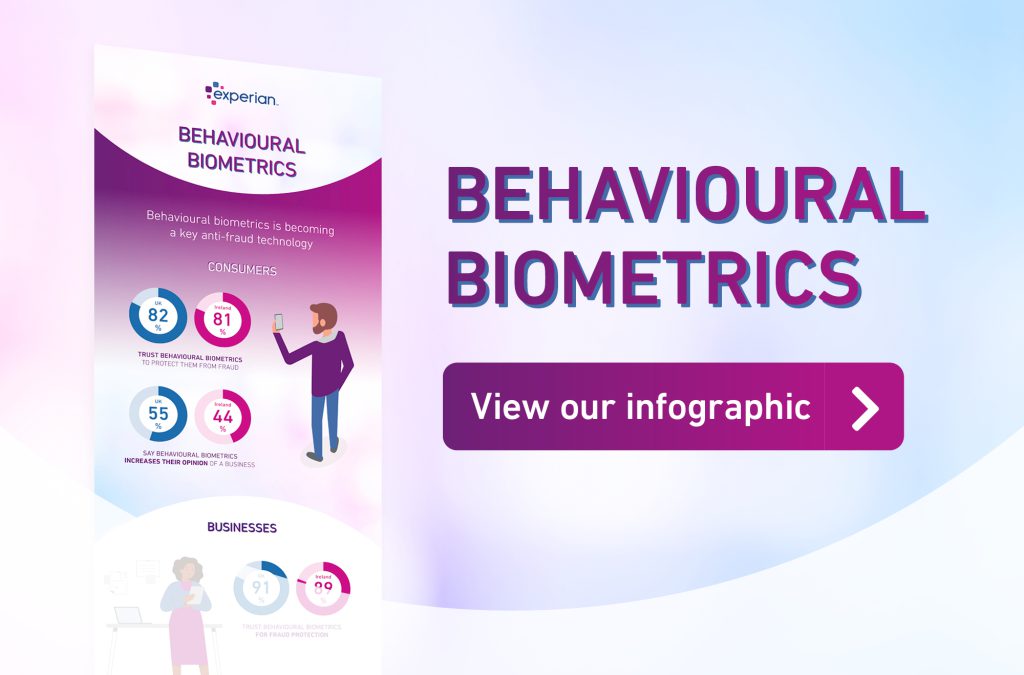

In recent years, as solutions have become more sophisticated and effective, organisations have come to trust and value behavioural biometrics as a key tool in the anti-fraud arsenal. So much so, in fact, that 91% of UK businesses and 89% of businesses in Ireland say they have a high level of confidence in behavioural biometrics when it comes to detecting and protecting against fraud.

According to this years’ Experian report, it seems that a healthy 82% of UK customers (and 81% in Ireland) now trust behavioural biometrics to prevent fraud. What’s more, 55% of UK customers (44% in Ireland), say that the use of behavioural biometrics would enhance their opinion of, and trust in, a business or organisation.

Key insights from the report: the public trust in behavioural biometrics

- 22% of UK consumers (13% in Ireland) are aware of behavioural biometrics and how it is used

- 82% of consumers in the UK (81% in Ireland) trust behavioural biometrics to protect them from fraud

- 55% of UK consumers (44% in Ireland) say behavioural biometrics increases their opinion of a business

In this year's UK&I Identity and Fraud Report, we explore the concerns, preferences and needs of today's digital consumers.

Download the full reportBehavioural biometrics as a key asset in the anti-fraud arsenal

One of the key findings of the report this year relates to organisations’ broad-based investments in a range of identity and security solutions. As the fraud landscape becomes increasingly complex, companies are investing in multiple solutions that contribute to improved security and fraud prevention. At the same time, customers are accepting a greater range of anti-fraud technologies and methods, prioritising their online security over preferences for any particular anti-fraud solution.

But while investments in security and anti-fraud solutions remain diverse, behavioural biometrics is playing a key role in augmenting organisations’ existing capabilities. This is evidenced by the fact that around 15% of organisations in the UK and Ireland are currently investing in, or planning to spend on, behavioural biometrics solutions for consumer identification and authentication.

Key insights from the report: organisations investing in security and anti-fraud solutions

- Behavioural biometrics – 12% in the UK (17% in Ireland)

- Device-in-hand solutions that use one-time passcodes or push notifications – 20% in the UK (30% in Ireland)

- Physical biometrics, including fingerprint, facial or voice recognition or retina scanning – 15% in the UK (20% in Ireland)

- Two-factor or multi-factor authentication – 12% in the UK ((23% in Ireland)

It’s worth noting that while multiple security tools will always be needed to maximise fraud prevention, these should be seamlessly integrated and orchestrated across processes and channels to avoid silos and security loopholes that can be exploited by fraudsters. In this way, all kinds of fraud – including APP fraud – can be identified and prevented.

For more insights on the growing importance of behavioural biometrics in the fight against fraud, download the full report here. You can also contact us today for details of Experian solutions, and how we can help you to create multi-dimensional, fully orchestrated fraud defences that protect your business and customers as the fraud landscape evolves.

Sources

[1] Fraudscape 2022, Cifas

[2] Internet Organised Crime Threat Assessment 2021, Europol

[3] Fraud – The Facts 2020, UK Finance