What is fraud analytics?

Fraud analytics is the blending of data analysis, strategies, and machine learning to calculate the overall likelihood of fraud. It’s an extra layer on top of typical fraud prevention to improve how fraud and financial crime are detected and prevented.

As fraudulent tactics become more advanced, the methods to detect and prevent fraud need to evolve too. Artificial intelligence (AI), machine learning (ML), and real-time monitoring are key tools in staying ahead of criminals and those trying to game the system. It’s not just about keeping up; it’s about being a step ahead.

Whether you’re a business, bank, or lender, your customers expect top-notch service and the latest technology to keep them safe. And fraud analytics is how you can. By using fraud detection data analytics, you gain a deeper understanding of fraud techniques, uncover hidden insights, and make smarter decisions that effectively protect your customers.

What is fraud analytics?

Fraud analytics is the blending of data analysis, strategies, and machine learning to calculate the overall likelihood of fraud. It’s an extra layer on top of typical fraud prevention to improve how fraud and financial crime are detected and prevented. For example, you may do separate checks on email, phone, and tools like Hunter that each show low to medium risk. However, combined, it becomes more suspicious and worthy of investigation – that’s how fraud analytics keeps your customers safer.

By using data analysis, statistical modelling, and machine learning, fraud analytics can detect suspicious patterns and abnormal behaviour across data types in real-time. This helps organisations quickly recognise and address potential fraud to prevent financial losses and protect their reputation.

Why does fraud analytics matter?

Fraud analytics is how businesses can keep on top of the ever-evolving fraud landscape. Previously in fraud detection, data points have been siloed, making it difficult to paint a full picture of an individual’s fraud potential. However, by bringing all these datasets together, fraud analytics can give a more accurate, more effective fraud probability score. Traditional human-based systems, such as a fraud manager deciding what is risky, are proving insufficient in the face of evolving fraud tactics.

In today’s digital landscape where, according to UK Finance, just 14%[1] of all transactions in 2022 were made in cash, the relevance of traditional fraud controls is in question — almost everyone involved in fraud now leaves a digital trail. Not only that, but fraudsters are becoming increasingly sophisticated. It’s more important than ever to leverage the latest technology to uncover fraud before it happens.

Fraud data analytics is now an indispensable tool in the ongoing battle against financial fraud[2]. The severe financial, reputational, and legal repercussions of fraud underscore businesses’ need to shield themselves and their customers proactively.

The benefits of fraud analytics

The adoption of fraud data analytics offers a plethora of benefits. For example, it can help:

- Find fraud faster and more efficiently

- Prioritise risky applications

- Grant good customers a happier, smoother journey

- Ensure investigators are only working the fraudulent cases, allowing for better time efficiency

It helps organisations reduce financial losses by identifying and mitigating fraudulent activities in real-time. It also enhances the customer experience by preventing fraud without causing unnecessary disruptions. This, in turn, fosters customer trust and loyalty.

By utilising fraud data analytics, organisations can streamline operations, optimise resource allocation, and comply with regulatory requirements more effectively. A closer look at some of the benefits include:

Big data fraud detection: Incorporating big data in fraud analytics is a game-changer. It analyses vast and diverse datasets in real-time, making it easier than ever to detect subtle patterns and trends that may indicate fraudulent behaviour. This is vital in today’s digital age, where large amounts of data are generated and processed daily. | |

|---|---|

Enhanced decision-making: By analysing an individual’s combined data, you can make more informed decisions regarding the probability of fraud. This data informs a more targeted and efficient approach to fraud prevention. | |

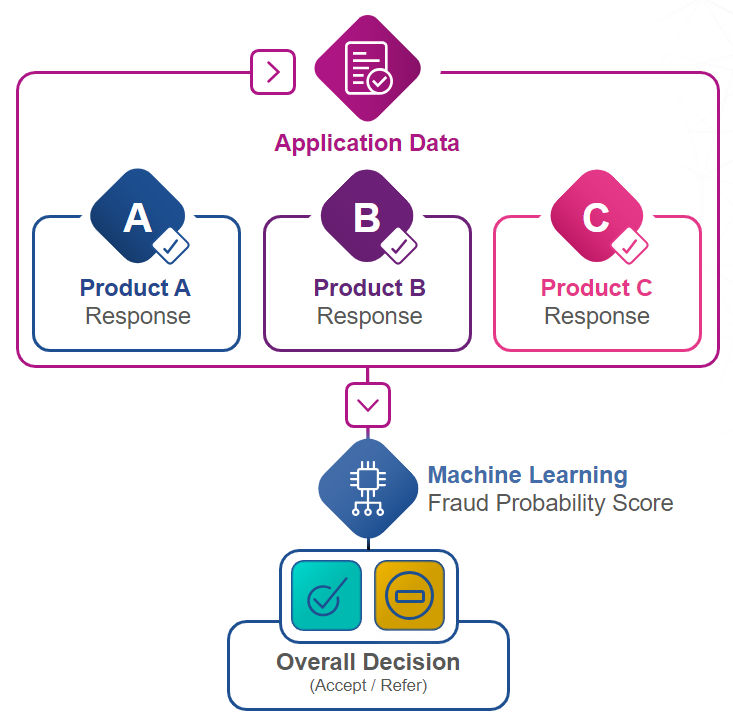

Holistic decision-making with ML: Instead of relying on separate findings from different products or indicators (such as email, mobile numbers, ID checks or IP addresses), machine learning can synthesise information from all these sources and more, providing a more thorough and accurate assessment of fraud likelihood. | |

Improved predictions: Fraud analytics enables better predictions of fraud risks. Using advanced algorithms makes it possible to spot recurring patterns and anomalies that humans can miss, allowing for proactive measures. | |

Fewer application referrals: Because fraud analytics combines multiple sources of identification, it provides a more accurate fraud probability score for applicants. This reduces the number of application referrals, and therefore manual checks your teams have to complete, streamlining operations and saving time. |

In short, fraud analytics, especially when incorporating big data and machine learning, empowers organisations to stay ahead of evolving fraud tactics, minimise false positives, and make more reliable decisions in the fight against fraudulent activities.

Who is fraud analytics for?

Fraud data analytics is relevant for a wide range of industries, including (but not limited to) banking, e-commerce, healthcare and insurance. It is particularly useful for organisations that deal with sensitive customer data and financial transactions. Read on to find out how it is used among financial institutions and the banking sector.

Using fraud analytics in banking

Fraud data analytics has become key in safeguarding financial institutions, harnessing AI, ML, and data analysis to detect and prevent fraudulent activity in real-time. Banks can proactively identify suspicious patterns, peculiar transactions, and potential security breaches, protecting their assets, reputation and customers.

Fraud analytics gathers and analyses data such as transaction data, customer data, biometric data and data from external sources, to understand each consumer’s typical behaviour better. This allows banks to quickly and easily flag and investigate suspicious behaviour, preventing the loss that fraudulent activity could cost a customer and the bank alike. This is accomplished in a few ways:

- Forecasting: Between predictive analytics and AI tools, advanced analytics can help banks predict the possibility of fraud. This helps banks assist their customers in identifying signs of fraud and bolstering their account security.

- Machine learning: ML algorithms can analyse transaction data to pinpoint abnormal activity patterns and use biometrics — including fingerprints, face recognition and voice recognition — to detect suspicious activity. It can also learn from past fraud cases and adapt to new fraud patterns so banks can quickly flag suspicious transactions. Machine learning-powered fraud prevention has now become accessible to a range of organisations thanks to out-of-the-box machine-learning probability scoring modelling.

- Real-time monitoring: The same way a smart security camera can alert authorities about theft as soon as it occurs, real-time analysis in advanced analytics can help banks respond the instant that fraud is attempted. This allows banks to be proactive and stop crime in the process.

Fraud analytics use cases in banking

These fraud analysis tactics are employed in various aspects of banking operations, such as:

- Account protection: Fraud data analytics tools identify unauthorised account access attempts, helping save customers from significant financial loss.

- Customer onboarding: Banks use fraud data analytics to verify the identity of new customers fast and ensure they are not impersonating someone else.

- Fraud risk predictions: By employing predictive analytics, financial institutions can proactively assess and rank transactions based on their likelihood of being fraudulent, allowing for prompt intervention and prevention. Consortia memberships, like those offered to Experian customers, are also a great aspect of fraud analytics, as you’re able to access data from across the UK’s most popular banks for full fraud visibility.

- Transaction monitoring: Real-time monitoring of transactions allows banks to detect unusual patterns and intervene when a fraudulent transaction is suspected.

By continuously monitoring and analysing vast amounts of data, fraud analytics enhances a bank’s security measures, minimises financial losses and fraudulent applications, and maintains the trust of their clientele in an ever-evolving and dynamic financial landscape.

How does fraud analytics work?

A powerful tool in the ever-evolving landscape of cybersecurity and financial integrity, fraud analytics combines data science, statistics, and machine learning to detect and prevent fraudulent activity. By scrutinising large amounts of data, fraud analytics identifies patterns and irregularities that may indicate potential fraudulent behaviour.

Fraud analytics techniques are diverse and dynamic, ranging from rule-based systems to sophisticated machine-learning algorithms. At its core, data analytics plays a pivotal role in preventing fraud by sifting through colossal datasets to uncover hidden patterns. Traditional methods involve establishing rules and thresholds to flag suspicious transactions (predefined guidelines of normal behaviour, where anything outside them could be seen as suspicious). But as fraudsters become more sophisticated, so do the analytics techniques. This is where machine learning comes in.

Fraud analytics techniques

How machine learning makes fraud analytics possible

Machine learning is a game-changer in fraud analytics. Unlike rule-based systems, machine learning models learn from new data, making them highly effective in identifying fraud patterns.

These models examine past data to understand normal behaviour and then identify any deviations that might indicate fraud. From anomaly detection to predictive modelling (see definitions of both below), machine learning algorithms elevate fraud analytics to new heights.

The stages of fraud analytics

Fraud analytics utilises a step-by-step process to provide a complete guard against fraud.

Data collection: First, extensive datasets are gathered from diverse sources. This may include transaction logs, user behaviour data, and external databases. | |

|---|---|

Data preprocessing: Once collected, the data undergoes preprocessing to clean and transform it into a usable format. This ensures the accuracy and reliability of the subsequent analyses. | |

Pattern recognition: Analytics techniques, including ML algorithms, are applied to recognise patterns within the data. This involves identifying normal behaviours as well as potential red flags that might indicate fraudulent activity. | |

Predictive modelling: Like pattern recognition, statistical algorithms and mathematical models analyse historical data to predict potential future outcomes. This allows for more informed decisions around fraud risk. | |

Anomaly detection: Anomalies – deviations from the expected patterns – are key indicators of fraud. Advanced analytics, like ML models, excel at uncovering these anomalies, even in a digital sphere that is constantly changing and in flux. | |

Alert generation: When potential fraud is detected, an alert is generated for further investigation. Equipped with the information that triggered the alert, human analysts can better assess potential fraud threats. | |

Response and adaptation: The final stage is where action is taken. The action will depend on what was found in the analysis. This could include blocking suspicious transactions, strengthening security measures, or updating the analytics models so they can keep up with new fraud tactics. |

How Experian stays ahead of the curve

Our 200-person-strong analytics community and dedicated innovation team equip us to stay on top of fraud trends.

One of the key features that sets Experian apart is our Fraud Score. It’s built on a complex algorithm that evaluates transactions and activities in real-time. And with our consortia membership, this includes data points from banks across the UK so we can effectively determine the risk of fraud in real-time and batch.

Fraud attempts are an ongoing reality, but fraud analytics can help banks and their customers anticipate, detect and combat the risk. To find out more about fraud prevention tools and services, you can find a selection of handy guides on our website, or speak with an expert today.

Advanced machine learning models are built into Hunter and ready to use out-of-the-box. Avoid costly and time-consuming R&D, compliance and technical hurdles.