What are gaming vulnerability checks?

Gaming vulnerability and financial risk checks are reviews to protect established players from getting into financial difficulty from habitual gambling. The checks can be used to understand the extent of an online player’s spend across different games and accounts.

Online gaming has become much faster and more accessible than ever before. So much so, it’s estimated the industry has around 24.7 million[1] individual players and is worth over £14.3 billion in the UK alone.

This accelerated growth has captured the attention of the Government and the Gambling Commission who have implemented more rigorous checks around a player’s financial wellbeing. The aim? To keep players safe and protect them from gambling beyond their means.

Whilst the majority of players gamble safely and responsibly, it is estimated that 2.2 million people, which is 20% of players, may still be at risk of financial harm. In fact, from 2022 to 2023, the number of people who sought help for problematic gambling increased by 30%[2].

Gaming firms are now under increased pressure to prepare for the impending regulations that will see a player’s spending thresholds being used to initiate checks on their financial wellbeing. To complete these checks, credit bureau information will be vital.

This guide explains what you need to know about credit bureau data and how it will be used to inform these checks, so you can get your business ready for regulation changes and deliver safe, sustainable gaming.

What are gaming vulnerability checks?

Gaming vulnerability and financial risk checks aim to protect established players from getting into financial difficulty from habitual gambling.

Targeted an online players, these checks can also be used to understand the extent of a player’s spend across different games and accounts. Bureau-based vulnerability checks can also be used to create a Single View of the customer/player across their gaming spending.

These financial vulnerability checks cover playing:

- Online poker, slots, and casinos

- Online sports betting, such as horse racing or football

- Virtual gaming platforms

- eSports (short for electronic sports – a form of competition using video games)

Creating a safe online environment, in which both the operators and gamers know the boundaries for sustainable and responsible gaming, is part of the Government’s recent gambling legislation reform. The 2023 white paper[3] introduces the principle of using credit bureau data to understand a player’s financial health and make vulnerability checks. It also outlines a list of measures and obligations for operators to adhere to that prevent unchecked and unaffordable spending.

Whilst the majority of players gamble safely, 20% may be at some risk of financial harm and around 3%[4] of online accounts have been identified as problem gamblers or sustaining unaffordable losses by the Gambling Commission. As such, they may require more support. It’s for these players where credit bureau data is seen as a useful source of information on their financial resilience.

A brief background into the checks

Public data, such as County Court Judgements (CCJs) and bankruptcies, is already being used to understand a player’s financial health. However, other sources that get drawn upon, such as modelled postcode estimates of income, have been shown to be frequently inaccurate and insufficient in providing a proper understanding of an individual’s finances.

Similarly, open banking is used by some operators to validate sources of funds and income, particularly for high stakes gamblers. This is an excellent source of data, but sharing this information requires a player’s consent. Data concerns also come into play here, as open banking can often disclose too much information than is required to inform a decision.

With the The Information Commissioner’s Office confirming that GDPR does allow credit bureau data to be shared with gambling operators for the purposes of enabling financial risk checks, operators now have a unique opportunity to improve their understanding of players and their capacity to gamble.

In accordance with GDPR, the information that is shared must be limited to what is necessary. In response, the Gambling Commission is now consulting with the industry on its use of this data. Gambling operators must protect the data they receive from credit rating agencies and must not use it for purposes other than carrying out a financial vulnerability check.

What information can support vulnerability checks?

Access to credit bureau data allows gaming firms to take a ‘light-touch’ yet informed approach to assessing financial vulnerability and risk, that is personalised to each player.

There are a variety of data and sources you can use to understand a player’s financial resilience. These are to be used alongside a more robust version of the traditional checks, such as verifying a player’s age and identity.

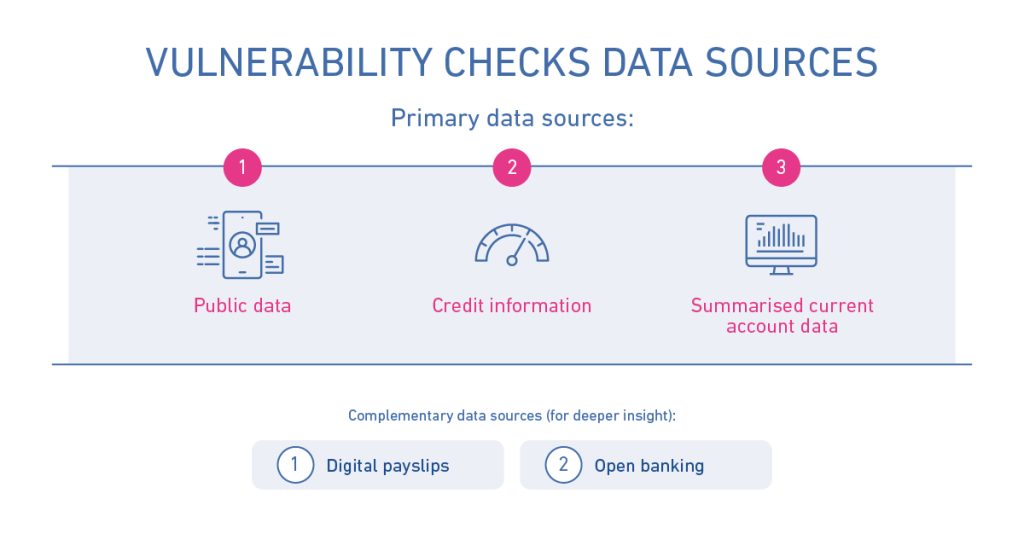

There are three primary data sources:

- Public data

This includes CCJs and bankruptcy notices, some of which are already in use by the industry.

- Credit information

This includes credit searches, credit scores, utilisation and indebtedness, payment performance, cash advances and overdraft use.

- Summarised current account data

This includes income and expenditure, and income shock and debt to income ratios. This may be summarised as a set of simple indices or red, green, and amber flags to validate income and identify low financial resilience.

All of the above data should be updated monthly, so you can keep pace with any changes in a player’s financial status.

Other complementary data which can also be considered to provide a deeper insight includes:

- Digital payslips

You can confirm financial stability through payslip information, sourced directly from a player’s employer. Access to this however must be consented to by the player.

Our Work Report™ service automates the exchange of data and avoids the sharing of physical or false documents. It verifies a player’s employment status, their income, and identity.

- Open banking

Open banking data requires consent in order to access bank statements that help verify a player’s identity and employment. This in turn helps to inform Due Diligence and Anti-Money Laundering (AML) checks.

Our Open Banking service provides a more detailed assessment of a player’s financial risk, offering analysis of their income, expenditure (including gambling), current account balance and overdraft.

The impact of vulnerability checks

Understanding the impact that these vulnerability checks have on players is essential. This is because a fair and proportional approach is needed when identifying vulnerable players.

Vulnerability checks have the potential to impact a player’s enjoyment or cause anxiety.

As such the Gambling Commission is currently consulting with the industry on their adoption of credit bureau data. This retrospective analysis can give gaming operators essential insight into how many customers require additional monitoring of their spending or are at risk of problem gambling. It’s an early warning to protect players from potential harm and provide a more sustainable gaming experience.

Why is checking vulnerability important?

They safeguard and protect vulnerable players

The primary goal of a vulnerability check is to ensure a safe environment for players and to enable sustainable gaming. Identifying possible issues and stepping in before they get too bad protects players from betting beyond their means. It also contributes to the corporate social responsibility of those operating within the industry.

They facilitate the creation of a Single Customer View

Back in 2020, the Gambling Commission encouraged operators to create a Single Customer View. This is a method that allows gaming firms to gather all of their players’ data in one record, and in doing so create a comprehensive view of their gaming behaviour. Operators can use the technology employed by the credit bureau to identify multiple accounts for the same player within their customer database and identify a player’s total level of spend across different gambling accounts. Seeing a complete picture of a person’s online gambling history makes it easier to spot potential risks. Establishing a Single Customer View using bureau data and sources like digital payroll can then help identify bonus abuse and avoid its associated revenue leakage.

The provide a personalised and proportionate understanding of risk

Using postcode or modelled income data to estimate financial wellbeing is outdated and inaccurate. Credit rating agency data provides a more detailed, nuanced, and sophisticated picture of an individual’s headroom to gamble which can be aligned to their spending. In turn, the Gambling Commission’s proposed spending thresholds can provide a more targeted response to harmful behaviour that better reflects an individual’s vulnerability.

How to adhere to the regulations

By better understanding a player’s financial vulnerability, you are better equipped to protect them and your business.

To give you a clearer idea of when you should step in, as well as the confidence that you’re adhering to regulations, we recommend:

- Getting to know more about credit bureau data

Start now and get to grips with bureau information to better understand the insight it provides and how best to deploy it within your business. Use retrospective analysis to test and learn prior to implementation so you see which data is most relevant and provides you with the best insight.

- Understanding the impact of data on your business

Knowing how the data impacts your business means you can better prepare for and mitigate against the risks involved. This in turn can help you create more sustainable and enjoyable gaming experiences.

- Keeping on top of changes in a player’s finances

Ensuring your business has real-time access to a credit bureau means you can see any changes with player behaviour. Monthly updates to bureau data make it easy to spot any emerging risks, allowing you to respond and limit potential damage.

How we can help

To help you understand more about player’s financial risk and the impact of impending reform, we’ve put together a comprehensive Gaming Guide. It includes information and guidance on:

- Working with a Single Customer View to build an accurate picture of your customers and use data sources that help you reduce the risk of financial damage.

- Ensuring you’re prepared for market changes, by learning from other industry benchmarks and making sure you adhere to all regulations.

- Discovering what an Enhanced Player Protection Check is, as well as the main reasons it may be needed.

You can also speak with our specialist Gaming Consultants who’ll be able to provide a personalised financial risk analysis report for your business.

[1][2] UK Gambling Industry Statistics in 2023: A Comprehensive Overview, The London Economic

[3][4] High stakes: gambling reform for the digital age, GOV.UK