The cost-of-living crisis – predictions for 2023

The continuing cost-of-living crisis

As we leave 2022 and enter the New Year the UK is still deep in a cost-of-living crisis which is forecast to continue throughout 2023 and potentially into 2024.

This crisis is hitting every household in the UK and for many households it is important that they receive all the help and assistance available to them to help them through the next 12 months at least.

However, whilst every household is being financially challenged a high proportion of UK households are somewhat resilient to increasing costs and can continue to consume goods and services and even afford a few luxuries.

Has inflation reached its peak?

Inflation has more than doubled during 2022 to 11.1% (as at end Oct) the highest level of inflation for over 40 years. The year began with firstly petrol then energy prices souring and all along the cost of food has steadily increased, and finally interest rates were increased to their highest level for over 10 years to add more financial strain on homeowners plus the potential of a further increase in December.

However, there is some better news on the horizon with many commentators including the Bank of England forecasting that inflation will stabilise and eventually fall during 2023 as they strive to hit the government target of 2% in 2024.

UK spending power has fallen during 2022 and will fall further in 2023

The average amount of money UK households have available to spend after paying all the bills has fallen by around 10% in the last year and is predicted to fall further during 2023.

UK Average Discretionary Income (estimated)

| 2021 | 2023 | Drop |

| £1,505 | £1,209 | 19.68% |

This crisis has polarised the financial resilience of UK households and really stretched the ability of the less affluent to manage to pay for essential items.

A look to 2023

Our Mosaic segmentation classifies every UK household into one of 15 groups. If we then look at the average spending power of each group after paying for essential items, we clearly see that every group has been affected. When we compare spending power in 2021 to estimates for 2023, we see a couple of distinct groups of “haves” and “have nots”!

The table shows the reduction in spending power by each Mosaic group between 2021 and 2023.

Spending power = Discretionary income – Discretionary income is defined as the average amount of money a household has to buy non-essential goods and services after paying for a basket of 31 Essential items as defined by ONS.

The have nots – the least affluent members of the UK population will all see reductions in spending power in excess of 25% with two groups, Family Basics and Municipal Tenants seeing reductions as high as 36% between 2021 and 2023. To add some quantification, this equates to 30% of UK households, that’s approximately 9 million households.

By contrast the have’s – the most affluent groups will all see spending power reductions below the average of 20% and continue to enjoy high levels of spending power and remain largely resilient to the effects of the cost-of-living crisis. By contrast, the have’s population is higher and equates to nearly 34% of all UK households, just over 10 million households.

If we then take this further and look at the UK population by discretionary income band, we can get a better understanding of how badly the crisis will affect pockets of the population and transversely how resilient certain pockets are to increased prices.

We can see that by the end of 2023, the number of households with £1000 per month or less to spend after paying the bills has grown to nearly 60% of all UK households.

| DI Band (Monthly income) | 2021 (% UK HH) | 2023 (% UK HH) |

| <0 – £125 | 7% | 15% |

| £125 – £1,000 | 42% | 44% |

| £1,000 – £1,500 | 15% | 13% |

| £1,500 – £3,000 | 22% | 18% |

| £3,000 + | 14% | 18% |

The number of households with the lowest spending power will grow to 15% and half of these will no longer be able to afford to pay for Essential spend and will have to make cuts to essential items just to survive.

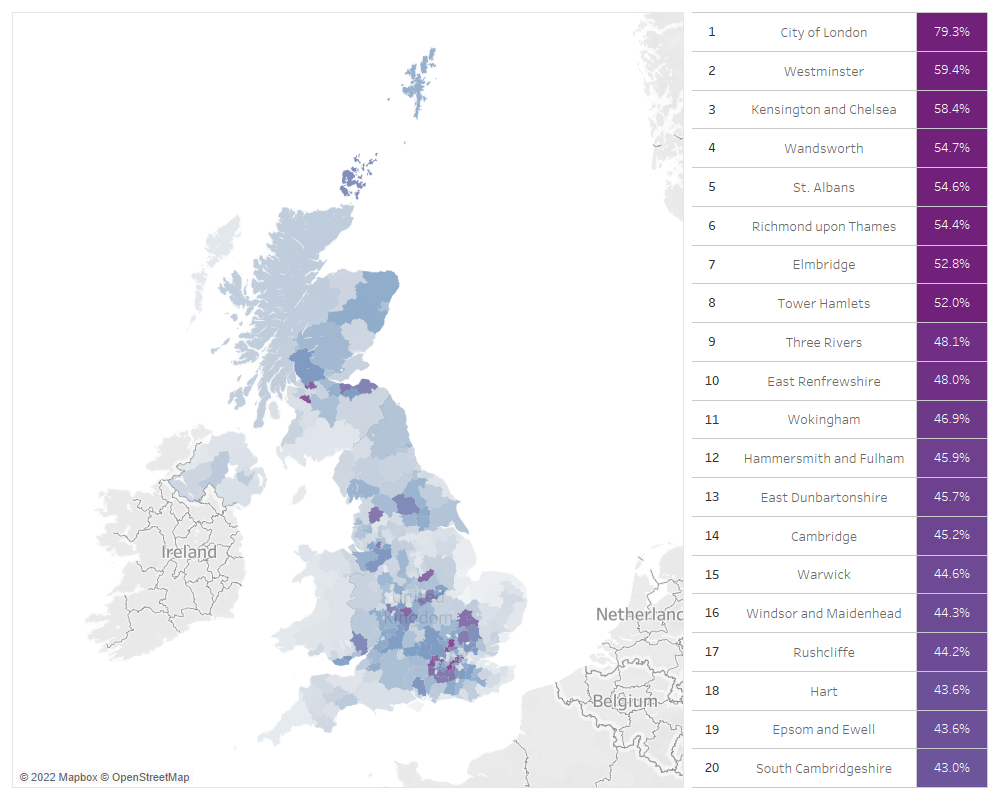

Where are the financially resilient

We observed earlier that the most affluent households have seen the lowest reductions in their relative spending power throughout the crisis.

And whilst their numbers are reducing, we estimate that over 10 million households that’s around 35% of all UK households will maintain a good level of financial resilience and will have more than £2000 per month spending power over the next 12 months.

But where do they live?

As you would expect London, the south-east, and a band flowing through the centre of the UK are the most densely populated local authority areas of the most financially resilient.

We expect these households to be able ride out the crisis and continue to maintain reasonable levels of non-essential spend on cars; holidays; eating out and entertaining.

As marketing budgets become even more squeezed and scrutinised through 2023 it will become increasingly more important to build additional efficiency into all marketing activity regardless of channel.

It will therefore, become increasingly important to understand how your target consumer has been affected by the crisis and understand if they are still in the market for your products and more importantly can they still afford to buy them!

How can we help?

Experian can help you reach your target audiences, to understand their needs and to serve them the right offers and products.

Its solutions can tailor interaction so that it happens at the right time, in the right locations and channels. It can also manage your existing customers using data insights and measure the outcomes of your marketing campaigns.

Get in touch

We have targeting solutions we can tailor to your business needs. Let's talk.

Get in touch