Who is buying electric cars?

As with all new technology we can have a reasonably good guess at who’s first in line. Those who adopt technology early and are into “shiny new things”, and have the means to afford what was, in the early days, an expensive purchase compared to the mainstream petrol or diesel engine. They would be joined by those keen to make an environmental stance and adopt a greener form of transport.

However, the earlier adopters are now being joined by more mainstream consumers, as the entry price for an electric vehicle drops and more used electric vehicles come on to the marketplace, making the purchase more affordable. We have moved on from solely early adopters and are heading towards the pragmatists, those who were not necessarily interested at first but are accepting the inevitable and joining the EV party.

Currently approximately 10% of private new cars purchased are electric, meaning that in the next eight years the remaining 90% will need to catch up, but clearly not all will do so at the same rate. We are therefore heading towards a race for the masses! Understanding who is next will be key for automotive suppliers, energy suppliers and of course those responsible for developing the infrastructure where on-street charging is necessary.

How can data prepare us for the EV revolution?

The right data moves us from knowing what is growing rapidly in the market to a deeper understanding of who is adopting at speed, and where opportunities lie.

Our insight uniquely links to the DVLA registration data, enabling us to link our segmentation information to those groups currently taking electric vehicles. Through identifying adoption curves we can then plot a likely path for over 60 consumer types.

Currently we know 33% of some consumer types purchasing a new car, are buying electric – the early, wealthy adopters. Other types sit at less than 1%. But our analysis shows where each type is likely to head in the future. By tracking this growth, we can identify some very interesting trends. For example younger segments, less affluent than the early adopters, living busy city lives are currently 50% more likely than the UK average to buy an EV. City dwellers have always been prime for EV sales, but what we can see from this new type is that lower incomes are finding EVs more affordable, in the new and used market.

What is today’s data telling us about EV purchases?

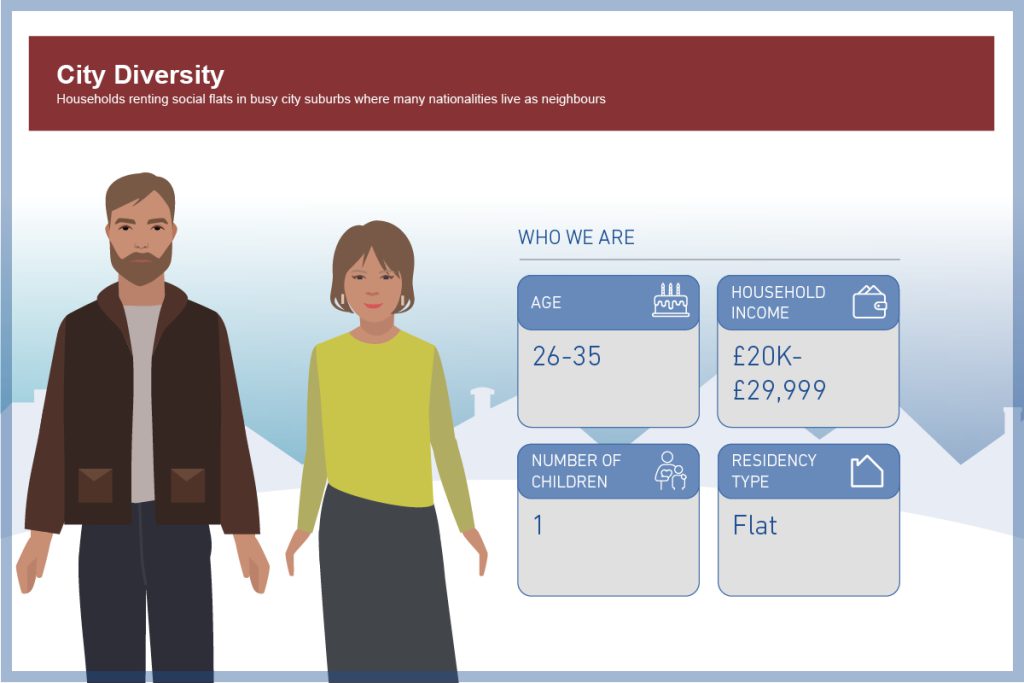

Through the power of data, we can see that people in different types are beginning to transition to EVs. For example, 14% of new vehicles purchased by those in the “City Diversity” type, who are typically aged 26-35, with a below average household income, are now EV.

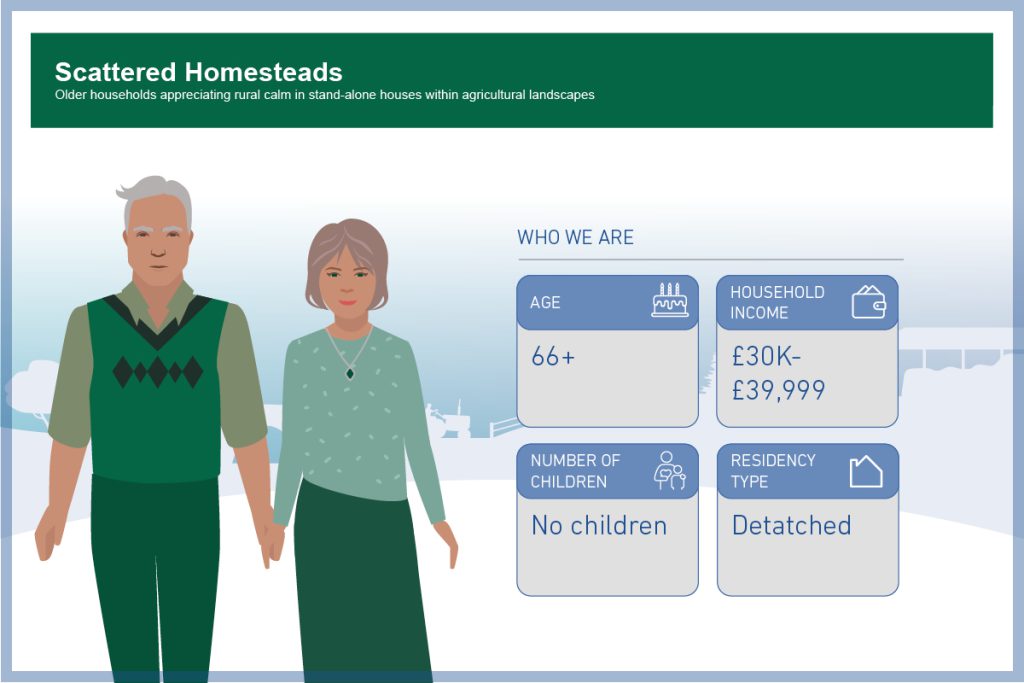

We can clearly see that city dwellers remain advocates of electric vehicles, but what about those in the countryside? Well in the early days these types lagged behind but given now the improving range of electric vehicles, those living in more rural areas can take advantage of such range to get to local towns and villages. Whilst we might consider those in rural areas to be more affluent, the highest recent growth has been in those over 60 years old with a more modest household income, compared to rural groups as a whole, once again highlighting the fact that affordability plays a part. In the ‘Scattered Homestead’ type, 15% of new vehicles purchased are EV.

What do buyers consider when looking at EVs?

With any new technology, there is a lot more to consider than simply “Can I afford it?” In the case of EVs, charging accessibility is a strong factor in deciding whether to make the switch. Do you need a driveway to charge your car? If you don’t, are there enough public chargers in your locality? The current perception of the charging infrastructure is causing potential users to be put off from making an EV purchase.

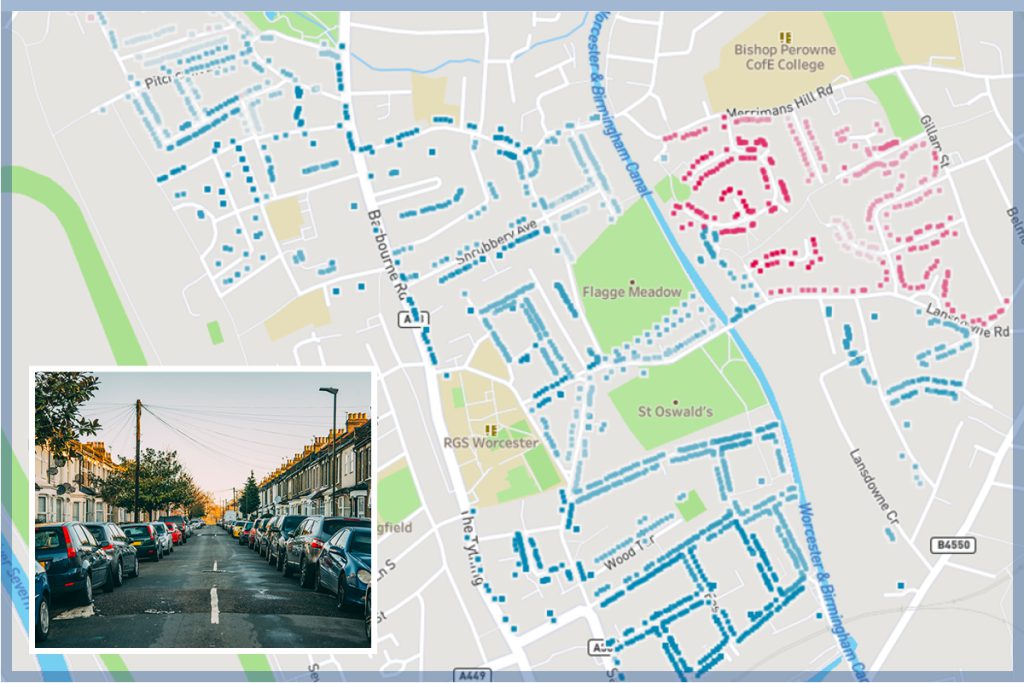

Again, through data, we can identify those most likely to buy an electric vehicle, alongside where EVs are already on the roads, link this to our accurate driveway model and instantly we can show the hotspots of EV ownership both now and in the future. Combining our EV predictions alongside our driveway model answers two specific questions:

- Where should more charge points be positioned to meet current demand, plan for future and encourage those segments holding back to move to an EV?

- Are my customers ready to switch? Will they have access to public charging? Or do they have a driveway, ready to install charger at their home, making the decision to move to EV much simpler.

These two questions are posed by two totally differing sectors, but we can answer both, using our adoption analysis and driveway modelling.

Recent work with a local authority shows at a granular level, where EV penetration is high and driveway likelihood low. The darker the dot the more need for on-street charging.

There is no doubt that we have moved on in the adoption curve; the mass market purchase is on our doorstep but simply assuming everyone will buy in the next 8 years, misses the real issue. Turning the “what” that most commentaries focus on, in to the “who and when” will be key to success in the market. Add to the fact that unlike the combustion engine we will all need our own private fuel supply for a refuel that takes on average 150 times longer than at the pumps, and clearly there will be infrastructure changes required at pace. Selling to those with the capability today for home charging makes sense and understanding where demand will be for on-street charging in the future, will mean an accelerated growth curve for those areas that get it right!

Find out more about our electric vehicle insights now.