The Ultimate Beneficial Owner GuideDiscover everything you need to know about UBO to ensure financial security and compliance for your business.

Guide

With ever-changing financial regulations and increasing economic challenges, it has never been more important to know who you’re doing business with.

An Ultimate Beneficial Owner is someone who has ultimate effective control over a business or asset. By knowing who the Ultimate Beneficial Owner is when it comes to the businesses you work with, you remain compliant with the Money Laundering and Terrorist Financing Prevention Act. Without this compliance you could be subject to penalties and at the risk of non-adherence to customer due diligence standards. This is as well as opening yourself up to risky business transactions and reputational damage, of course.

What is an Ultimate Beneficial Owner?

An Ultimate Beneficial Owner (UBO) is the individual who ultimately benefits from a company or asset, or has ultimate effective control over it. This is even if they’re not formally named as the business owner.

From combating fraud and financial crime to protecting your own company, knowing who an Ultimate Beneficial Owner is isn’t just due diligence on your part, it’s also a mandatory requirement for industries such as banks, estate agents, accountants, and solicitors.

So, to help your business steer clear of these risks, this guide will share everything you need to know about Ultimate Beneficial Owners. We’ll explain who they are, why they’re important, and how we can help you to identify them.

What is an Ultimate Beneficial Owner?

An Ultimate Beneficial Owner (UBO) is the individual who ultimately benefits from a company or asset, or has ultimate effective control over it. This is even if they’re not formally named as the business owner. To fully know your customer or client, you need to know who the UBO is.

A UBO is calculated by Experian as an individual who:

- owns 10% or more of a company’s shares

- holds 10% or more of the company’s voting rights.

What are Persons of Significant Control vs UBO?

Persons of Significant Control (PSC) and Ultimate Beneficial Owners are often the same person but on occasion, they can be different. A PSC holds the right to significant control over a company and the appointment of directors.

A PSC is defined at the individual who:

- owns more than 25% of the company’s shares

- holds more than 25% of the company’s voting rights

- holds the right to appoint or remove the majority of directors

- has the right to exercise significant influence or control

- holds the right to exercise significant control over a trust or company that meets one of the first 4 conditions.

For complex corporate frauds, understanding ownership and control is key for determining the extent of your exposure.

Ultimate Beneficial Ownership vs Legal Ownership

While UBO status does what it says on the tin and refers to the person at the ‘top of the tree’ in a business, you’d be forgiven for wondering how and why it differs from legal ownership.

Put simply, the legal owner is the ‘official’ owner of a business, asset, or property on paper. The UBO is the person who is entitled to any benefits it may bring.

In many instances, the beneficial owner and legal owner are one and the same. However, there are a number of reasons to have different people represent each role, with some of them not always legal. These include:

Money laundering

Assets and money earned through criminal means tend to be registered under a different legal owner to their ultimate beneficial owners. This is to obscure the UBO’s links with the activity. It is illegal.

Tax evasion

People or companies that register assets under different names and legal owners may be doing so as a way for beneficial owners to avoid paying tax. This is also illegal.

Anonymity

High-profile people, such as politicians or celebrities, may choose to register assets in a different legal owner’s name in order to maintain privacy and safety. This is legal.

How to identify an Ultimate Beneficial Owner?

Banks and financial institutions tend to follow a four-step check to identify UBOs. This is made up of:

1. Acquiring the entity’s credentials

This includes full and up-to-date company information such as names and addresses of top management employees for verification, legitimacy, and accuracy checks.

2. Researching the ownership chain

Which involves understanding the background of a company and who has shares or interests in it, as well as whether a person’s ownership is direct or indirect.

3. Identifying and verifying the UBO

This is done by understanding the total percentage of shares, management control, and ownership stake of every individual.

4. Undertaking an AML and/or KYC and KYB check

To better understand who you’re doing business with and check their level of financial risk.

There are also several data sources that can be used to screen and identify a UBO. These include:

- shareholder and subsidiary lists

- sanction lists

- the corporate ownership structure

- Politically Exposed Persons (PEPs) lists

- sister companies in the same group structure or with the same ultimate owner

- news and media in relation to that company.

While it is possible to do your own UBO checks following the above process and using the same data sources, it can be complicated and costly in terms of time and money.

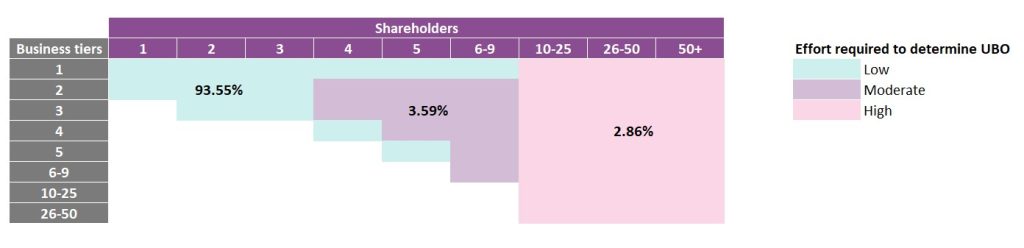

The below table illustrates the composition of the UK business universe by corporate complexity, using shareholders and the number of tiers in a business. Determining the UBO for the segment in green (low number of tiers and low number of shareholder) can be done in a few minutes.

Businesses within the segment in pink, while making up under 3% of ownership structures, can take in excess of half a day to determine the UBO. Using the Experian UBO algorithm these complexities can be handled to provide a more accurate instant decision.

Anti-Money Laundering, Know Your Customer, and Know Your Business checks

Anti-Money Laundering (AML), Know Your Customer (KYC) and Know Your Business (KYB) compliance are legal obligations for all companies that are regulated by the Financial Conduct Authority.

They aim to safeguard and legitimise any financial transactions you make by ensuring you know who you’re doing business with. They also assess the financial crime risk level of a person of business, to further protect you and your company.

AML, KYC, and KYB checks are integral parts of identifying a UBO and understanding who has ultimate control over an entity you’re doing business with. However, while they share a main objective, both checks look at different things:

![]()

Anti-Money Laundering

AML checks are vital – particularly for banks or other financial institutions – within customer screening as it helps to ensure those you work with are not likely to attempt money laundering through your business. The customer information that is typically needed here includes a passport, source of funds, and the relationships between signatories and beneficial owners.

![]()

Know Your Customer

A KYC check is mandatory and involves identifying and verifying a customer’s identity to ensure they are who they claim they are. This tends to be through proof of name, address, and income.

![]()

Know Your Business

A KYB check is mandatory and is the process of identifying and verifying a business’s identity, as well as the key parties involved with that business. This often means validating company information against multiple sources of data including Companies House, the Financial Conduct Authority, the Charities Commission, the DVLA, VAT registers, and more depending what industry that business operates in.

Why are Ultimate Beneficial Owner checks important?

Everything we’ve covered so far should give you a good idea as to why UBO checks are so critical. However, it never hurts to emphasise their importance.

Essentially, UBO checks are a series of detailed risk assessments that aim to combat fraud and prevent financial crime. These checks can also flag if an entity poses a politically exposed risk or if their business has been previously sanctioned. Both of which can be reputationally damaging to your company should you do business with them.

Complex corporate structures and layers of business ownership can make it easy for criminals to undertake money laundering activities. So, by knowing exactly which partners, customers, suppliers, and other third parties you do business with you can help unearth anything that seems awry or untoward. This is also known as understanding Key Parties, who are the individuals whose authority represents a company.

It’s also a robust way of protecting your own business, by ensuring you comply with UK laws and regulations, as well as safeguarding your money.

How can we help?

Researching UBOs to assess financial risk can be complex and time-consuming. Our team simplifies this process with our comprehensive UBO database, gathering data from Companies House to construct complete corporate trees. We accurately calculate UBOs by matching shareholders to directors, ensuring no hidden details are missed, thanks to our advanced algorithm.

With our team’s help you can:

- discover hidden UBOs across the entire corporate tree

- adhere to AML, KYC, KYB, and tax reporting requirements

- improve customer onboarding through smarter, more streamlined administration

- reduce the time and monetary costs of manual checking

- keep up to date with any changes to customers’ business ownership

- understand the ownership risks in your current customer portfolio.

To get started, speak with one of our experts today.