Can you trust who are you doing business with?

It is vital that all UK businesses (particularly in regulated industries) carry a robust identification and fraud management solution for customer onboarding.

Finding the right balance – between stringent controls and a seamless user experience – is critical to an outstanding customer experience for onboarding.

Using the right checks, at the appropriate time, based upon each specific risk profile, you can provide the right customer journey for each and every applicant

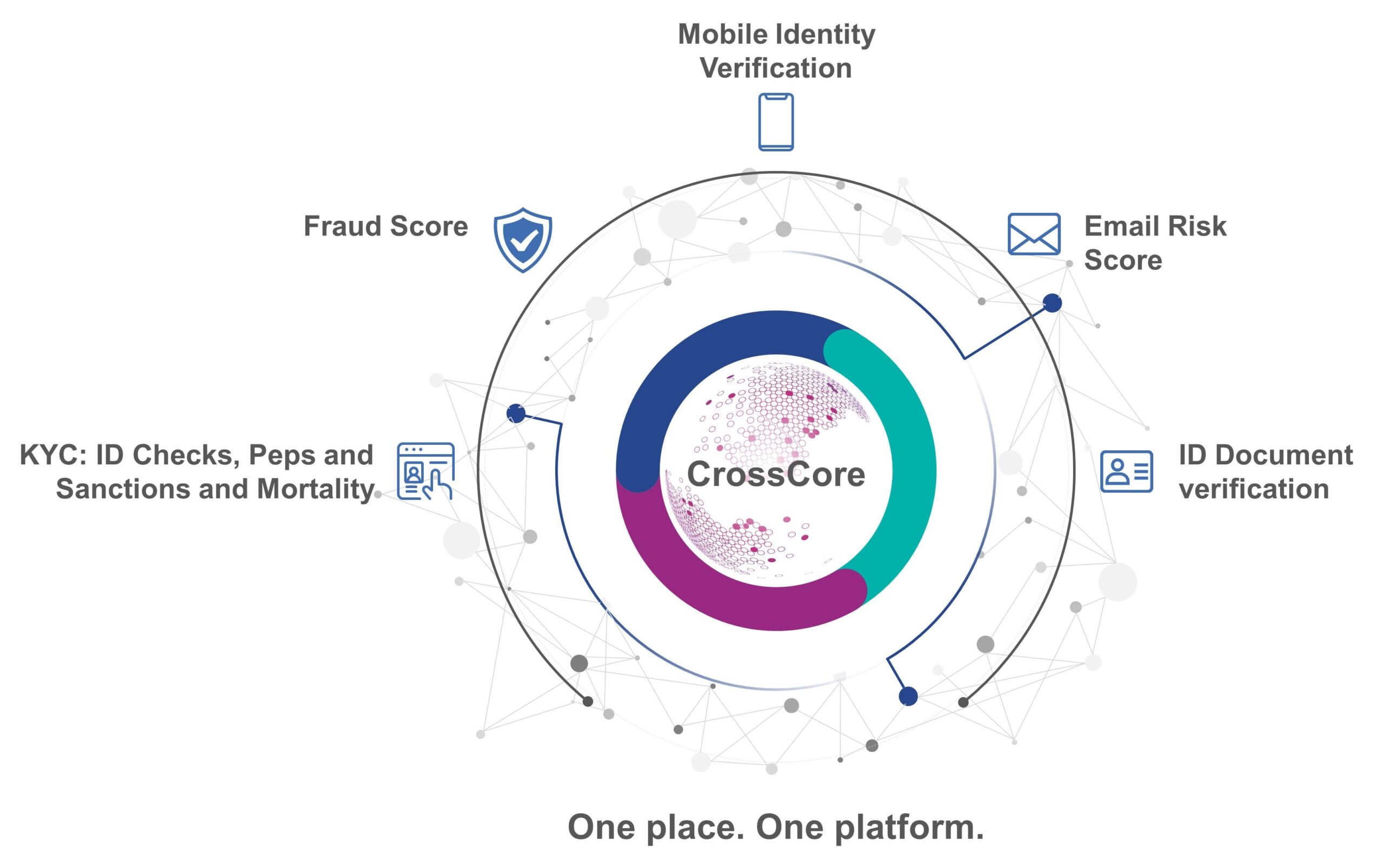

A multi-layered approach to onboarding

Taking a blended, multi-layered approach to onboarding, you maximise the number of “good customers” you can onboard, whilst protecting you and your customers against fraud.

What’s included:

- KYC: ID Check, P&S, Mortality: Validate a new customer’s identity and check if that identity is a politically exposed person, sanctioned or appears on mortality databases.

- Fraud Score: Having identified your customer, generate a trustworthiness score based on the data we hold for that person, with a recommendation to approve/refer (for further checks) or decline.

- Mobile ID Verification: Check the reputation of the mobile device number submitted in the application and whether it is associated with your customer’s identity.

- Email risk score: Check the reputation of the email address associated with your customer to ensure it hasn’t been associated with fraudulent activity.

- ID Document Verification: Check any documents provided by your customer are legitimate.

- CrossCore: Whilst a multi-layered approach is essential, a single platform provides the flexible, co-ordinated, future-proof solution that customer onboarding requires. CrossCore provides the assurity, of all checks in one place, in a single platform

Download product sheet

How can I access KYC Onboarding Solution?

We will provide a solution that fits with your budget and requirements, but you can rest assured that our data is collected, compiled and delivered to the highest possible quality.

Request a consultationThe benefits at a glance

Streamline the onboarding process

Simplify and streamline the onboarding process with a comprehensive solution

A single package

Leading identity verification and fraud management combined in a single package

Customer onboarding

Create an exceptional customer onboarding experience effortlessly

Cutting-edge capabilities

Leveraging the cutting-edge capabilities of Experian’s CrossCore platform

Ensure safety and protection

Ensure the safety and protection of your business and customers

The latest technologies

Stay ahead with the very latest tools and technologies

Achieve the right balance

Achieve the right balance between customer experience and fraud prevention