Join Experian UK and Ireland

Be a force for good and help create a better tomorrow

We're proud of our award winning 'People First' Culture, this includes Great Place to Work and Top Employer accreditation. You'll see your own inclusive values are represented in our policies, our employee network groups, our culture and our partnerships.

Ready to join us?We are the largest provider of data in the world. We influence real change on a global scale and offer you a seat at a table that you can be proud of. To reflect our vision, we are committed to investing in our communities and giving back.

We are passionate about what's next for you. We reward curiosity and promote growth. We believe the workplace should be a place of personal, professional and emotional fulfilment. You can expect everything you need to progress your career.

We work to turn data into something meaningful. We gather, analyse, combine and process it to help people and organisations achieve their goals

One side of our business focuses on financial access. As a Credit Bureau, we use data to help millions of people gain financial access. We don't make lending decisions, but we do provide information to help banks, mortgage lenders, credit card issuers and other types of creditors make decisions.

The other side is built on powerful modelling and data/decision analytics. Digital innovation is reshaping the way we function. Experian's at the heart of it driving change for our clients and customers all around the world.

We value transparency and insist upon a high trust environment. We want you to feel empowered to drive innovation and have endless opportunities to create meaningful impact in all that you do. By drawing upon the combined strength of our diverse workforce, we’re stronger as a business and can better serve and represent our clients and customers.

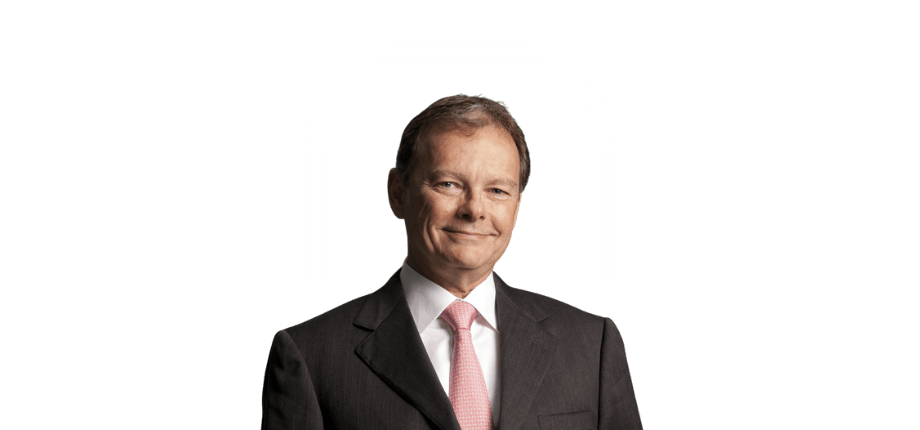

CEO Experian UK&I

Human Resources Director UK

CTO Experian UK&I

Pension contribution

Annual bonus scheme

Car allowance (depending on role)

ShareSave plan

Renting & mortgage advice

Life assurance (4x basic salary)

Salary finance (loan repaid via your salary)

Hybrid working

Employee Network Groups, including LGBTQ+, Black at Experian & Women in Experian

Dedicated wellbeing programme

Perks - Online discounts portal, Gym flex, Bike for work

Annual travel ticket loan

3 days Paid Volunteering

24/7 GP Service

Critical Illness cover

Bupa Private Medical Insurance, including gender transition treatment and fertility treatment

Employee Assistance Programme - fast, free and confidential support

Mental Health support, incl. mental health first-aiders

26 weeks full pay for maternity & adoption leave

18 weeks full pay for shared parental leave

6 weeks full pay for secondary caregiver leave

Paid leave for fertility treatment

Paid leave for neo-natal leave

Support and advice when caring for elderly relatives

CFO

"Everyday I’m looking at new products, new technology and that’s what is really exciting. Experian drives collaboration, everyone works together to make sure we are successful. It really is a positive culture to be part of"

Graduate Data Scientist

"Experian is a data playground, you literally couldn’t ask for more data. There is such variety in what we do, what we offer and what you can learn that nowhere else could match it really. I’ve gained invaluable knowledge and experience through my graduate role so far – and I can’t wait to find out what else is to come!"

Business Analyst

"Great teams to work with and alongside. Supportive senior stakeholders within the business that help you progress and meet your goals. Stakeholders across the business have really embraced agile working. Opportunities to shadow or work in other departments for a set period of time per week to improve your skills.

People really care and value you as a person. Huge support on mental health if needed. Hybrid working policy - if you don't want to go the office you don't have too"