Understand the impact BNPL spend has on an individual’s credit worthiness

In July 2022, we released our first guide for lenders on insight revealed from our analysis of Buy Now, Pay Later (BNPL) transactional data being shared into our bureau.

With more data from multiple lenders now flowing into our bureau, this second paper seeks to build on this original analysis to assess the impact of BNPL against the backdrop of increases in the cost-of-living, squeeze on household incomes and forthcoming Christmas shopping season.

Get to the heart of how consumers are using BNPL services to manage their finances, and what this means for lenders.

Uncover our latest research

Lenders need to start considering the role of BNPL transaction data in understanding the full extent of an individual’s credit commitments, to better understand and monitor financial well-being, ensure good outcomes and to demonstrate adherence to Consumer Duty.

Use of BNPL continues to grow

As of September 30th 2023, Experian had processed a total of 53.8m BNPL transactions with a combined value of £3.7bn across 5.9m unique customers.

The largest user base comes from those aged 39 or younger who represent 57% of all users

But throughout 2023 the fastest growth came from older, less risky customers aged between 45-64.

The number of customers making at least one transaction a month remains consistent at 2m

The average number of transactions made by each customer decreases with age. However, for all age bands we see the highest transaction value is over £2,300.

In this report, we cover:

Transaction volumes

Our analysis suggests that the volume of BNPL transactions in the UK will continue to grow

Behaviour and spending trends

BNPL is still widely favoured by younger consumers who have very different attitude towards credit

Credit consumption

With BNPL providers now sharing consumer’s transaction data with credit bureaux, Experian can provide lenders with a more complete view of a customer’s credit consumption that includes visibility on their use of BNPL

Getting a more accurate understanding of risk

Given the transactional nature of BNPL, and the short outcome period, Experian has been able to develop a view on the performance of BNPL services and how this compares to other products

A sneak peek into:

Getting the full picture: Making Buy Now, Pay Later payments visible

Behaviour and spending trends

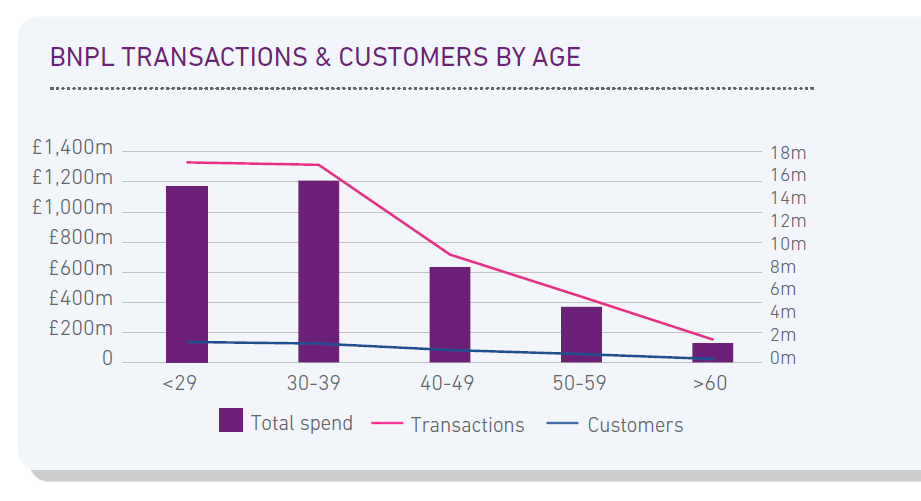

By some distance the largest user base comes from those 39 or younger and these customers represent 57% of all users. This is split equally between those 18-29 (29%) and 30-39 (28%) with the numbers then decreasing as we progress through the age bands.

Over the 10-month period, we see the average number of transactions made by each customer decrease with age: the figure peaks at 10 transactions with an average spend of ~£740 in the 30-39 age band dropping to 6.2 at an average spend of ~£400 for those 60 or over.

These, however, are only averages and for all age bands we see the highest transaction value being in excess of £2,300. This is why lenders need to look at each consumer individually when assessing their use of BNPL versus their consumption of other sources of credit.

Did you enjoy the read?

Download the report "Getting the full picture: Making Buy Now, Pay Later payments visible"

Read our paper to get to the heart of how consumers are using BNPL services to manage their finances, and what this means for lenders.