Lost opportunity and hidden risk in commercial lending

The challenge faced by a major UK high street bank

Over recent years, increased competition in the commercial lending space because of the CCDS (Commercial Credit Data Sharing) regulation and explosion in fintech and alternative finance lenders, has resulted in many businesses taking out credit from multiple lenders, meaning traditional banks have far less of a complete picture using their own internal data alone.

A major UK high street bank has partnered with Experian to understand and help quantify the lost opportunity and hidden risk within its commercial customer portfolios and the role that commercial bureau data can play in mitigating challenges as a result.

Case study 1: Identifying lost opportunity

How a major high street bank identified opportunity lost from good customers going elsewhere for new commercial credit.

The challenge

A Tier 1 high street bank recognised it was losing market share amongst one of its core product lines but was unsure where this was happening and how to mitigate against it.

- The bank currently does not have the capability to see new lending with other providers.

- A lack of visibility on commercial lending elsewhere means they are unable to see or differentiate which customers they should have won or retained versus those they rightly rejected at application stage.

- Opportunity is being lost to competitors, but they have insufficient data to pinpoint where and how to turn it around.

The approach

Experian undertook a retrospective analysis using our Commercial Credit Account Information Sharing (CAIS) programme, which encompasses comprehensive data on commercial lending from the market, including details and performance data on each credit product so that it is possible to understand if a business is up-to-date or in arrears or default on its payment obligations at a granular level.

By taking a view of applications from the lender in question over a set period of time, for example rejected applications vs. accepted applications that were either taken up or not taken up, and comparing different cohorts against the bureau, we were able to see which of these prospective customers went on to take out credit successfully with another provider within 6 months and for similar products and credit amounts.

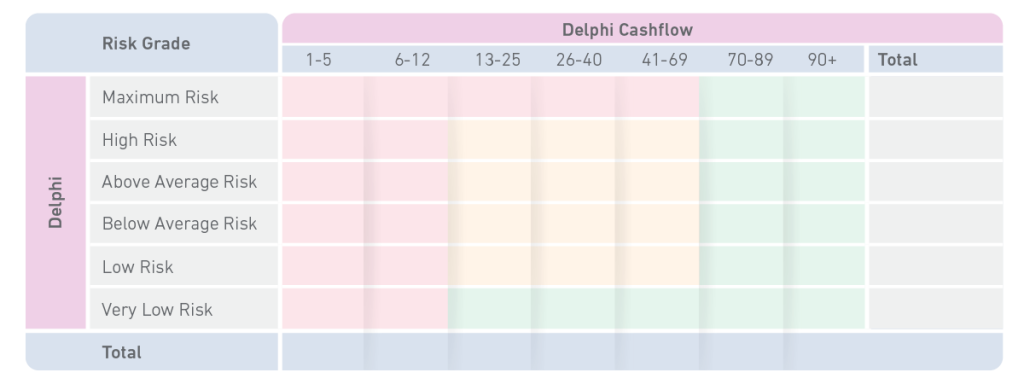

Clearly, applications may be legitimately rejected on creditworthiness grounds, so a risk grade was created from a blend of Experian’s credit scores, such as Commercial Delphi and Delphi Cashflow, and a good/bad outcome flag was used to valid results. We were then able to identify a low-risk cohort that represented lost opportunity.

Table 1: Indicative image showing the risk grade calculated for Commercial Delphi and Commercial Delphi Cashflow

The results

- 22% of rejected applications were identified as very low risk and went on to be good customers with other lenders.

- £14m of additional business identified that could have been written without increasing risk appetite.

- Cohorts identified to help future targeting and tweaks to policy rules to retain some of this lost opportunity.

- Supporting data to help understand recommended changes.

Case study 2: Hidden portfolio risk (blind spot analysis)

Shining a light on hidden portfolio risk by having a full view of your commercial customers .

The challenge

A Tier 1 high street bank realised it had no visibility of the ‘hidden risk’ associated with external credit agreements taken out, which may not have been performing despite the customer being up-to-date with their own credit facilities. We identified that 40% of their existing customer portfolios had borrowing elsewhere, representing a sizeable risk.

- This Tier 1 bank does not currently have the capability to fully understand and monitor the full credit risk profile of their 1m+ business customers.

- Although in the majority of cases they hold the bank account and therefore have transactional data, they still have blind spots without having a complete 360° view of their customers.

- They cannot always ‘see’ whether a customer with debt facilities owing to other lenders are meeting their repayment obligations or not, potentially transforming the risk profile of the business.

The approach

Experian undertook a retrospective analysis using our Commercial Credit Account Information Sharing (CAIS) programme, which encompasses comprehensive data on commercial lending from the market, including details and performance data on each credit product so that it is possible to understand if a business is up-to-date or in arrears or default on its payment obligations at a granular level.

Retrospective analysis was undertaken of the bank’s SME/Business Banking portfolios using specific observation points across a two-year period to assess the credit status of those businesses at the given time. The analysis aimed to identify pockets of high-risk businesses that the bank could be blind to in order to prove the value of the data.

The results

- £350m+ exposure identified at risk where there was a true blind spot – all these businesses whilst up to date on the Tier 1 bank credit agreements were struggling to meet repayments on debts with other lenders.

- More than 1,000 businesses identified as extremely high risk where the lender increased their exposure by £7m+ despite these businesses having experienced significant arrears events elsewhere unbeknownst to the bank and with a bad rate of more than 31%.

How can we help?

- Lost opportunity and hidden risk analysis – run this analysis on your own application and existing customer data.

- Commercial Delphi for Customer Management (DCM) with Commercial CAIS and Commercial CATO provides lenders with an up-to-date view of all their customers’ commercial borrowing across multiple providers, not just their own to assist with customer management.

- Commercial Delphi Generation 6 is our latest flagship commercial risk score, available for onboarding and customer management, incorporating the latest bureau data including Commercial CATO.