Taking the pulse of UK financial services

As the UK is currently experiencing an economic crisis, it is crucial to make sound decisions to safeguard struggling customers, identify areas of growth, and enhance the customer experience. With the progression of technology, lenders can access large amounts of data to make quicker and more accurate decisions about their customers.

Where is the sector right now in its use of data and technology, particularly artificial intelligence and machine learning. Thus, we opted to investigate this matter.

Our research delves into the barriers for technology take up within financial services

We surveyed over 200 representatives from UK financial services companies to gauge current attitudes to AI, ML and cloud technologies as well as performing qualitative analysis through small group think tanks and roundtables. Our aim was to explore how companies are using AI and the cloud, where they’re seeking to invest and what they perceive to be the barriers for greater adoption.

AI and ML continue to be adopted

In particular across data management, fraud risk decisioning and credit risk modelling.

Digitisation continues to dominate investments

Improved customer experience, conversion and process digitization to increase automation are top areas of focus.

Monitoring and assessing existing processes are critical

Capital, customer risk and affordability and all areas of focus for improving real-time understanding and supporting actions.

Monitoring is a key focus

Lenders want to monitor capital, market and customer risk and opportunity.

In this report, we cover:

How are lenders looking to grow?

Growing market share profitably and reducing portfolio risk are key challenges.

Existing AI should be improved

Companies are focused on improving the performance of existing models, over introducing new ones.

Shifting from the old to the new

Lenders are looking to respond quickly to changes in customers' financial circumstances.

A sneak peek into...

Greater agility through augmentation and transformation

Breaking down the barriers to next-level analytical decisioning

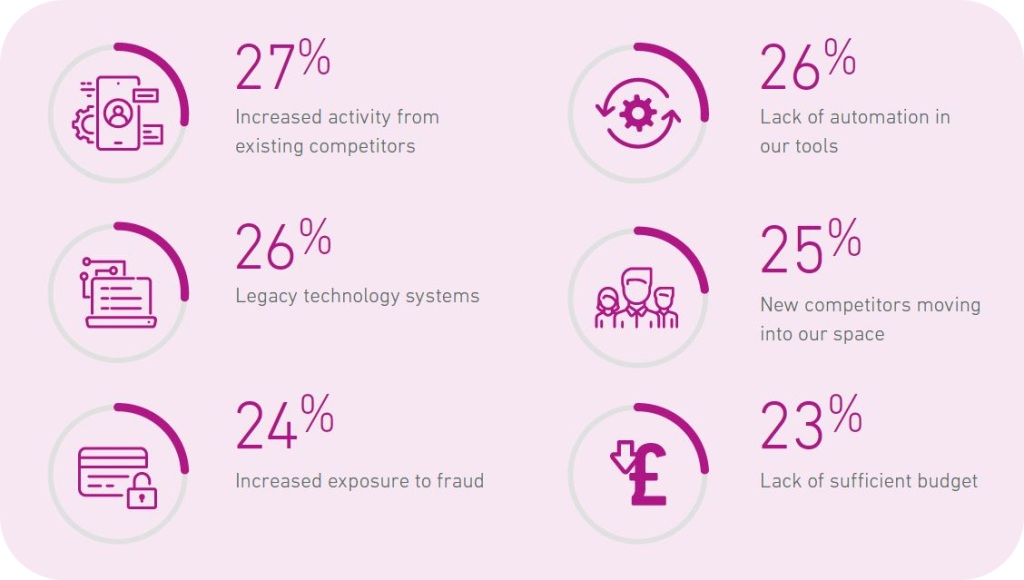

Financial Services companies want to invest more in AI, enhance their models with better analytics and different data sources, and make faster, more accurate decisions to serve their customers.

But as our survey highlights, companies face barriers to enhanced AI and machine learning techniques including cost, technical complexity, lack of internal support and concerns over effectiveness.

Barriers to enhanced AI and ML

Experian is uniquely placed to help you overcome these obstacles, thanks to our strength in data, decisioning and analytics.

Did you enjoy the read?

Download the full report

Find out all the insight from our latest research, and how today’s lenders are integrating technology into decisioning processes.