The new legislation and code which help to protect young people include:

- Offensive Weapons Act 2022

- Age Appropriate Design Code

- Online Safety Bill

These regulations require retailers and other online companies to verify that customers meet age requirements before they’re allowed to proceed. This means that age verification at the point of delivery is no longer adequate, and requires immediate change to traditional online sales and age-verification processes.

“With the pandemic accelerating online banking, shopping, and video streaming, the risk of underaged customers accessing adult products has increased dramatically. The government has taken action to protect younger customers in the form of new age-verification legislation, and organisations must take rapid action to ensure compliance.”

Traci Krepper, Head of Propositions & Portfolio Marketing, Experian

As well as meeting regulatory requirements, it’s often necessary to verify a customer’s age for other reasons – for example, during online onboarding processes for bank accounts, credit cards and other financial products. This not only ensures that customers are eligible in the first place, but it also supports identity checks and other necessary Know Your Customer (KYC) activities.

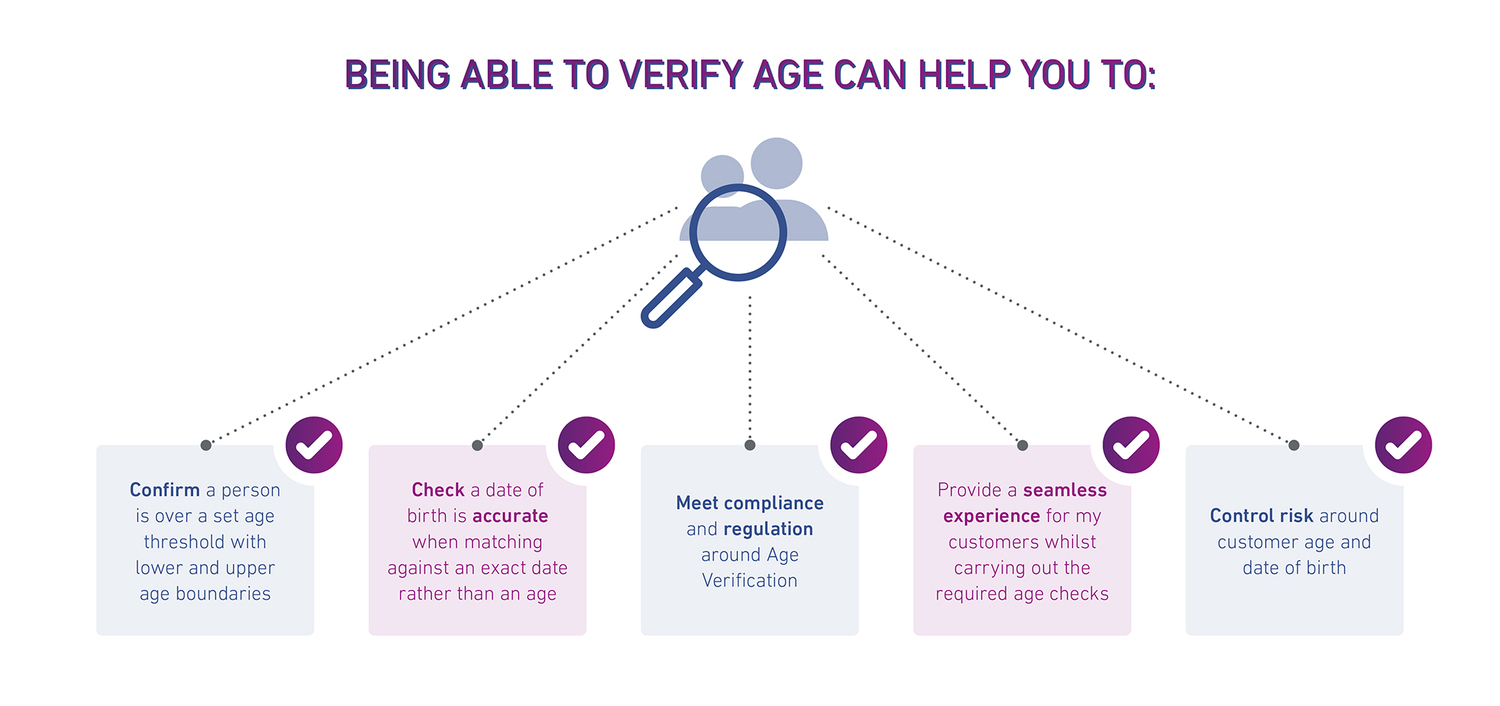

To meet both their regulatory obligations and onboarding needs, businesses that interact with customers online need to verify customers’ ages and/or dates of birth extremely accurately. What’s more, age-verification solutions must minimise friction for the customer journey, making it as convenient as possible to access and pay for goods, services, and content.

Maximising customer protection and convenience with ‘age-range’ verification

Age-range verification is typically used when a consumer is required to verify that they’re above a certain age limit – in the UK this is usually 18 years of age, though this does vary depending on the nuances of the specific product, content, legislation or code. This protects younger customers by checking that they meet the age requirements for accessing goods or services, with a lower impact, more convenient check.

Age range verification cross-references the information provided at check-out with data from public and non-public sources. The purchase is then either approved or denied in real-time based on a simple web-services call before the customer is allowed to proceed.

With age-range verification, there’s no need to distinguish between a customer who is 18 years old and another who is 65. Instead, the solution simply determines that both customers are over the minimum age limit and can therefore access the product or content they’re requesting.

Accurate date of birth checks for online customer onboarding

Accurate date of birth checks for online customer onboarding

However, when an age range is not enough, there are times when a specific date of birth verification is required. For instance, customers wishing to open a new bank account or apply for a credit card, typically need to provide much more accurate information about themselves during the onboarding process. This includes their date of birth, which is an important piece of data – both for ensuring that the product or service is suitable for them, and also for identifying them and carrying out the required credit checks and other checks needed to meet regulatory and KYC requirements.

In such cases, our date of birth verification solution can help to verify that the date a customer provides is the right one by cross-referencing it with credit bureau data, publicly available data sources, and – if required – other trusted data sources. This is also a low-friction process for customers with all the validation checks carried out behind the scenes, and the approval (or denial) returned in real-time.

How can we help?

To protect young people from potentially harmful goods; help organisations meet their regulatory obligations; and provide decisioning certainty for financial institutions onboarding customers online, we’ve created our age and date of birth verification solutions. These provide highly accurate and timely age and date of birth checks based on access to billions of regularly updated data items, including our own credit bureau.

To find out more about our solutions and how they can help your business streamline regulatory compliance and improve your online customer onboarding process, please contact us.