Assessing affordability using Commercial CATO and CAIS

In our previous blog we discussed the various methods for assessing affordability for SMEs

In this article we take a closer look at how current account turnover and commercial CAIS data are used to get a better picture of SME affordability.

The Small Business, Enterprise and Employment Act 2015 brought in new data sharing principles (CCDS) designed to help facilitate greater choice in the commercial lending market, specifically for SMEs (businesses in this case with a turnover of less than £25M). It did this by requiring banks to share not only all their lending data which was previously on a voluntary basis under SCOR (Steering Committee of Reciprocity) rules, but also summary Current Account data (CATO), on a monthly basis.

Why share commercial data?

The CCDS regulations aimed to create a level playing field for data. The plan was to foster competition and to increase choice for SMEs by allowing organisations to use the CATO data if they would, in return, share their lending data with the credit reference agencies, even if they don’t have a Current Account product (which restricts access to CATO data in consumer lending).

Within banks, this data has been used for many years to facilitate Risk Assessment and Limit Setting, allowing them to develop powerful scoring models and effective affordability assessments (based on loss rates), thereby giving them a considerable competitive advantage when lending.

This data is now available as part of the standard Experian Commercial Bureau data process, so can be retrieved at the point of application or in batch for existing customers.

Furthermore, this data is also open to trade creditors who are not financial providers as long as they contribute their ledger data to Commercial CAIS. The CATO data provides an in-depth and up-to-date picture on a business through monthly snapshots from banks. It includes Credit and Debit Turnover, balance data (high, low, average & end of month) as well details on returned items and days in excess of overdraft limits.

The benefits of a detailed picture

This detailed picture of their cash flow health helps in a number of ways:

- Lenders can create more predictive scoring models. These are shown with both Experian’s new Commercial Delphi Generation 6 and Delphi Cash Flow scores and the big improvements in scorecard performance and Gini.

- Lenders can create policy rules to refine score decisions. Examples might be: no income for x months, declining income, debit turnover in excess of credit turnover, signs of stress in balances, excesses and returned items.

- Lenders can calculate affordable limits for SMEs.

Banks have for many years used CATO data to calculate automated lending limits for their customers as it provides an in-depth view of SME cash flow, including their income and likely expenditure, and therefore the capacity to take on debt and thus to successfully offer pro-active limits to their customers. This success was one of the primary reasons the government mandated the release of this data. To enrich the income and cash flow view from CATO, CAIS data provides a detailed view on the Financial Credit products used by a business and includes data on loans, overdrafts, asset finance, commercial cards, commercial mortgages, telco and payment acceptance data. CAIS holds around £150 billion of active commercial debt, mainly in the SME segment, providing details on type of facility and age, limits and balances, any arrears including the history, term and monthly repayment as well as additional card details. This allows us to see the level of debt, monthly debt servicing cost and performance in meeting their obligations – important in both calculating affordable limits and assessing risk.

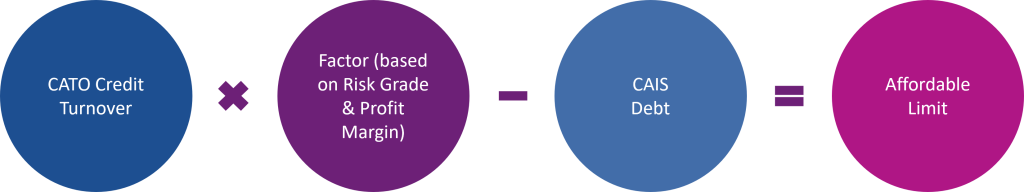

To calculate an automated affordable limit the following information is used:

Income

This figure is taken from the CATO Credit Turnover (CTO). This provides both an Annualised view but also the average monthly credit turnover of the business. Average CTO can be calculated after topping and tailing to remove big swings to get to a more stable monthly income, but this approach can adversely impact seasonal businesses and those with lumpy turnover patterns.

Risk and sector factors

This allows restricted or zero limits to be applied to high-risk businesses and larger limits for low-risk ones. Business margin is used alongside the risk view to help understand spare cash flow to pay off debt. Understanding business margin is difficult as only credit turnover and debit turnover can be seen on the current account. However, Companies House data on >£10.2 million businesses provides indicative EBITDA/gross profit levels by sector which can be used to set conservative sector-based margin factors to feed into affordability calculations.

Existing debt obligations

This comes from CAIS (own company and other lenders) and allows us to understand current repayment obligations and levels of debt both short- and long-term.

Calculating affordable limits

This data is then used to calculate affordable limits. There are two main approaches which can be taken here:

Overall debt limit

This uses annual credit turnover and the risk/margin factors to set an overall affordable unsecured limit for the business from which existing debt (term balance plus overdraft & card limits), is subtracted to provide a “total net new borrowing limit”. As part of this, any debt repayment on existing facilities needs to be taken in to account. With this approach caps may be applied on total unsecured credit new borrowing reducing the total net new borrowing limit available. Where a business has long-term lending commitments, such as a commercial mortgage, or is applying for this type of facility then this method is not, however, ideal.

Monthly repayment limit

This uses the average monthly credit turnover of the business, coupled with the risk/margin factors to set an overall affordable monthly repayment amount for the business. From this, the monthly cost of existing credit commitments is subtracted to create a “net new monthly repayment limit”. Within this approach a proportion of the overdraft and card limits is typically used to feed into the monthly cost of existing credit commitments. This is different to consumer lending calculations where a proportion of the outstanding balance is typically used. Again, lending is possibly capped for the customer/product etc., based on risk, product, and exposure. In this approach, long-term lending commitments such as commercial mortgages are considered in the initial repayment calculation.

Whilst use of CATO and CAIS data offers strong levels of insight into the affordability of an SME, other methods of assessing are available including using categorised bank account data.

How can we help?

We help lenders to achieve a “full picture” view of affordability by sourcing and analysing CAIS, CATO, Open Banking data, macro-economic forecasts and a range of other relevant data sources, subject to the size and scale of the facility being requested, and level of associated risk.

As well as bringing together these key data sources, we use a categorisation engine to provide granular commercial affordability assessments based on a broad span of income and expenditure categories.

Our economic forecasts take account of the array of complex factors impacting commercial affordability from fluctuating interest rates, energy prices and inflation, to market variables and consumer confidence. In doing so, we can help you assess a business’ ability to pay throughout their facility lifecycle and help minimise risk to your portfolio.