How understanding your price comparison site performance can help optimise your lending

With price comparison websites continuing to be the first port of call for the majority of consumers seeking a new credit card or personal loan, it is increasingly important for lenders to stay abreast of developments in this space and ensure that their use of this highly important acquisition channel is optimised.

In this article we look at some recent aggregator insight and discuss how you can understand your organisation’s performance and how it compares to both peers and wider market experiences.

Benchmark your performance across the journey

Analysis shows that organisations who offer eligible consumers pre-approved offers can benefit from click rates of 2-3 times higher than the next highest likelihoods (i.e. likelihoods of 90% and 95%). Despite the increased performance in click rates seen on pre-approved offers, less than 50% of consumer enquiries that return an eligibility/likelihood to the consumer are for pre-approved offers. This could suggest that a number of organisations still have some way to go in figuring out how to confidently move towards the predominantly binary “yes/no” decisions that the aggregators, and arguably consumers, would like to see.

Insight and analysis into what is happening during the customer journey can highlight both areas of current strength and importantly, areas of potential opportunity. Performance across multiple metrics needs to be fully understood to identify and evaluate areas for development or enhancement. We’ve referred to click rates above and how these vary considerably based on the likelihood returned to the consumer, but there are of course other factors that will influence a consumer’s behaviour. In addition to where ‘in the table’ your offer appears (top, tied top or not top1) we know that the actual product (e.g. balance transfer duration, loan APR) and brand can also have an impact on click rates.

Are you winning where you are expecting, and wanting, to?

The customer journey does not stop after the click and application for the product. For non-pre-approved offers there is still the full decisioning process to be undertaken which can cause dropouts for numerous reasons.

An application may not result in an account opening with your organisation due to the credit assessment outcome (e.g. scorecards, policy rules, affordability) or perhaps the product terms offered during full decisioning did not align with the consumer’s expectations. Maybe there was something in the customer journey that caused friction resulting in a dropout for a customer you otherwise would have wanted to accept.

Combining third party data, such as that available from Experian, together with your own decisioning data can help you understand the drivers and quantify the value lost through the decisioning process. There will be consumers who exit the process and who do not go on to take new lending elsewhere, but there will also be segments of consumers who have their lending needs met elsewhere (“off-us”). It is the analysis of this subsequent “off-us” lending that can help inform the business requirements and priorities of change.

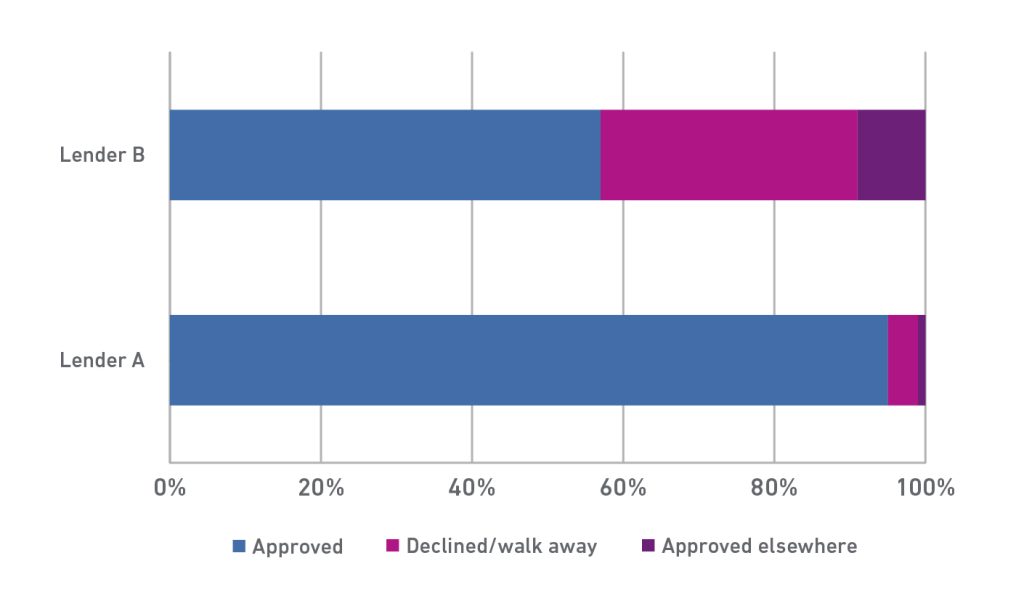

An organisation’s approach and sophistication in relation to eligibility likelihoods and pre-approvals has a large bearing on both conversion rates and the proportions of consumers seen taking out lending elsewhere. If we consider applications made for credit cards and analyse the outcome, specifically a measure of the percentage of applications that end up taking lending elsewhere, we see a variance of a factor of 9 times between the highest and lowest rates.

Graph 1: Lender B sees 9 times more applications ending up taking lending with a competitor (Numbers used for illustration only)

Benchmarking your organisation’s performance throughout the customer journey will highlight existing strengths and areas that could deliver an improved performance if enhanced.

Quantifying opportunities and driving change

Insight and benchmarking, in particular looking at the “off-us” lending, is important to review regularly to understand your performance relative to peers and the wider industry in what is a highly dynamic marketplace. Bringing together third-party data together with your own data, for example, will allow you to understand for each likelihood score that you returned:

- What percentage of these took out lending with your organisation.

- What percentage took lending elsewhere.

- What percentage took no lending.

Overlaying your organisation’s decisioning data may highlight opportunities to review your approach to credit assessment or affordability.

Let’s consider the group that take out lending elsewhere in a bit more detail. You could analyse the consumers where they returned high likelihoods (in this example let’s assume 90% and above) and look at the percentage taking lending with your organisation versus those taking lending elsewhere. These two groups could then be profiled by risk, affordability any other dimensions to understand where differences, both favourable and adverse, exist compared to peers.

The subsequent performance of these two groups can also be analysed and benchmarked. For example, and drilling down further into the high likelihoods, of those consumers that your organisation gave a likelihood of 95%:

- How did they perform with other lenders versus when they took lending with your organisation?

- If we consider personal loans, what were the average loan amounts, term and APRs other lenders granted?

- What were the subsequent payment profiles, delinquency outcomes and early settlement rates?

Understanding this will allow you to evaluate and quantify the value of the business that is being served by your peers over your own organisation.

You can use this third-party outcome data to challenge existing strategies and drive meaningful change. For example, if we consider credit cards, you could profile on-us and off-us lending resulting from an enquiry and application and focus, in particular, on your affordability and limit setting strategies. Looking at both an aggregate level and then drilling down by multiple dimensions (e.g., likelihood, risk score, indebtedness, affordability assessment) you could assess the credit limits assigned by your organisation and your peers on both balance transfer and non-balance transfer propositions. Analysis may show pockets of segments where assigned credit limits fall notably behind the limits being granted by other lenders.

Taking this one step further you can also investigate and compare the subsequent performance of the on-us and off-us lending by a number of behavioural and outcome metrics. Analysing activation rates, balance build, utilisation rates, delinquency rates and revolver/transactor rates may highlight segments where affordability and limit assignment strategies should be reviewed and enhanced.

As we move towards higher levels of pre-approvals across the industry, it is imperative not to fall behind current market standards and the expectations of consumers. One potential pitfall associated with a lower position in the table of returned offers is that of adverse selection. This can result in tranches of business that will not perform as expected with the outcome that financial hurdles are not met. This can in turn lead to changes (e.g. credit assessment, product parameters) that further harm the table position and attractiveness of the product offering.

How can we help?

At Experian we have a long track record of working with organisations to help them qualitatively and quantitatively benchmark their performance across multiple metrics. Our data assets and analytical capabilities in conjunction with our consulting expertise can help you identify previously undiscovered insights and turn this insight into actionable business strategies.

Our unique data and analytics capabilities are now available to help you better understand performance across your customer lifecycle. Find out how Ascend can power your lending decisions.

[1] Top = only one organisation at the top (based on highest likelihood returned, e.g. the highest likelihood returned is 95 and only one organisation has returned a 95).

Tied Top = multiple organisations have returned the same maximum likelihood for the consumer.

Not Top = where the likelihood returned by an organisation to the consumer is not the highest likelihood shown.