Why is cash flow management important?

Cash flow management can be the difference between success and failure

No matter what you sell, whether it’s products or services, cash flow management can be the difference between success and failure. But while staying out of the red may be a priority, late or non-payments from customers could seriously damage your finances – impacting your ability to pay suppliers and secure credit.

Careful management of cash flow doesn’t need to be complicated but it’s absolutely key to the success and indeed, survival of your business.

In this in-depth guide, we’ll show you how successful cash flow management can help you meet your costs and grow your business, even during uncertain times.

What is cash flow?

In simple terms, cash flow is the money coming into your business, and the money going out of it. The cash flowing into your business is known as cash inflow and includes the money you make from selling your products or services. It can also include money from other sources, such as investing and financing. The cash flowing out of your business is known as cash outflow. Examples of cash outflow include the payments you make to suppliers, costs like salaries and bills, dividends paid out to shareholders and expenses such as tax and business rates.

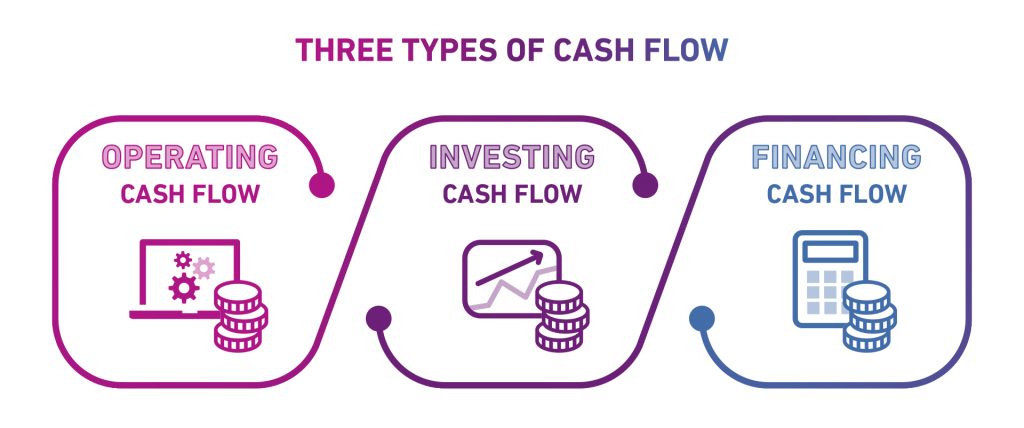

There are three types of cash flow:

Operating cash flow: Cash flow linked to producing and selling your products and services is known as cash flow from operations (CFO) or operating cashflow. In other words, your accounts receivable and accounts payable. Your operating cashflow shows whether or not your business has enough money coming in to pay operating expenses, such as bills and payments to suppliers. It can also show whether or not you have money to grow, or if you need external investment or financing.

What does cash flow management mean?

Cash flow management means tracking the money coming into your business and monitoring it against outgoings such as bills, salaries and property costs. When done well, it gives you a complete picture of cost versus revenue and ensures you have enough funds to pay your bills whilst also making a profit.

Investing cash flow: To adapt and grow, every business needs to invest in its longer-term future. Cash flow from investing (CFI), or investing cash flow, refers to the money you invest in areas such as research and development, or on capital expenditure such as new assets, equipment or premises. It also includes cash flow linked to buying and selling investment products like stocks and securities.

While you need more money coming in than going out for a positive operating cash flow, investing cash flow is different. Fast growing businesses often have times of negative investing cash flow, which shows stakeholders that they’re investing in expansion and growth.

Financing cash flow: Cash flow from financing (CFF) or financing cash flow is linked to how your business is funded, such as money coming in from bank loans and investors, and money going out on loan repayments for example. A positive financing cash flow can show that you’re investing in your business, but it can also be a sign that you’re relying on finance to keep your business going day to day, rather than bringing enough money in from selling your products or services.

Why is cash flow management important?

All business owners will want to avoid cash flow problems. However, due to their size and ability to access financial resources, SMEs are often disproportionately affected by negative cash flow.

Where a larger business may have funds available as a stop-gap between late payments, smaller businesses rely more closely on their predicted monthly income to ensure their financial commitments are met. In serious cases, business owners can be left with no choice but to use personal funds to keep their business afloat.

For ambitious businesses looking to grow, long term negative cash flow can put these plans on hold. Instead of investing time and energy into thriving, business owners will be left scrambling to stay afloat month by month.

A healthy cash flow is also important for a good business credit rating, helping you to secure finance, attract investors, negotiate with suppliers and win new business.

The main signs that show you need to improve your cash flow, fast

Effective cash flow management can help you spot potential cash flow issues early and avoid financial difficulties.

There are a number of common signs that your business may be facing financial difficulties – but they will only become clear once you’ve created a budget, set clear cash flow targets and are on top of your reporting. But what are the warning signs to look for?

Your business is making late or missed payments

If you notice that your unpaid invoices are starting to pile up, then you might have a cash flow problem. But even with automatic reminders set up, it’s impossible to pay your business bills if the cash just isn’t available. Whether late or missed payments are down to poor admin or no cash, they can result in a low business credit score, impacting your ability to secure finance, find suppliers and build partnerships..

You have a negative cash flow

While growing businesses’ cash flow can fluctuate between positive and negative as they invest in their future, a consistently negative cash flow could be a sign that you have more going out than coming in. Often, a negative cash flow can be down to an unexpected financial shock, such as a key client going out of business, or a vital piece of machinery breaking down. The best way to protect yourself is to plan ahead and manage potential risks, before they happen.

You’re missing out on the best deals

Many suppliers and providers offer benefits like early payment discounts, or discounts for paying in full. If you’re not taking advantage of the savings, you’re adding to your operating costs and reducing your cash inflow. It could also be a sign that your own payment terms aren’t in step with your suppliers. Improving your payment terms could ensure you have cash available when you need it.

You’re constantly juggling funds around to cover costs

With a positive cash flow, managing your costs will be simple. You’ll know exactly what is coming in and when, so you can set up payment terms on your outgoings that won’t be missed. If you’re struggling to pay your business costs and debt every month, it’s time to improve your cash flow. This could include increasing the money generated by your products and services, as well as improving your payment terms.

10 tips for managing your cash flow effectively

Below are 10 tips to help to tackle some of the cash flow problems you might experience.

1. Set a budget

Creating a budget is an important foundation for any business. By forecasting what you intend to spend and earn, you can determine ahead of time whether you have enough money for certain projects. From the outset you can identify whether your business costs and revenue streams are setting you up for a positive or negative cash flow. If it’s the latter of course, then you’re able to act, make changes and give yourself a better chance to stay positive.

2. Keep records

Of course, creating a budget and setting goals is all well and good, but if you don’t track your performance then your targets become meaningless. Once you have clear cash flow targets in place, you will need to keep records and review them regularly to identify any potential problems that will need addressing. Examples of key data you should track are:

- Income

- Uncollected cash

- Monies owed

- Regular expenses

- Available cash

- Inventory

- Individual revenue streams – which are making a profit, which are struggling etc.

- Gross profit

- Net profit

- How are you tracking against the previous year and previous quarter?

- How are you tracking against your competitors?

Where possible, seek your accountant’s support in creating a reporting system for your business. Keeping accurate business records is key to maintaining a good business credit rating, securing finance and investment, and meeting compliance with reporting responsibilities. A cash flow statement will provide information on where your business money is coming from and where it’s being spent. Over time, your historical performance will also help you to produce a cash flow forecast and spot any challenges and opportunities early.

3. Review your spending regularly

As prices rise, it’s essential to keep a close eye on what you’re spending. It will also help you to identify which costs are operating cash flow, and which are linked to investing cash flow and financing cash flow. Remember that your business costs could increase as you grow, so it’s important to work them out in advance, to make sure you’ll still have more coming in than going out. On the other hand, investing in things like technology could lower your operating costs, while increasing revenue streams.

4. Introduce a credit control process

Put a plan to place to make sure you’re paid on time, within your payment terms. A good credit control process includes:

- Due diligence – with tools like Experian Business Express you can check the business credit rating of any company – to identify clients that are likely to pay on time, and those who could pose a greater financial risk. Remember to check existing clients, as well as new ones. In a time of economic uncertainty, usually reliable clients could be facing their own financial difficulties.

- Clear payment terms – make sure your payment terms support your cash flow and communicate them clearly with your customers. Set out how much you expect to be paid, by when, and the consequences of late or missed payments. Remember, this is also an opportunity to support your customers and build brand loyalty. For example, by offering flexible payment plans, point of purchase financing, or early bird discounts for paying early. Always send your invoices on time and offer a range of simple ways for your customers to pay, including online.

- Staff training – ensure your team is up to date with your credit control processes and the importance of payments and cash flow. This isn’t just an important area for finance staff, it affects your whole business. For example, thinking strategically about your payment terms could help you increase sales and improve customer support, while focusing on investing cash flow could help you spot opportunities for growth.

5. Diversify your revenue streams

Offering a broader range of products and services could help increase your cash inflow and make you more resilient as customer needs change. It’s also important to make sure you’re not over-reliant on a particular client or supplier, especially in uncertain economic times. Carry out research to spot potential gaps in the market and benefit from new trends. For example, could you offer a subscription-based service to sell your products and services more regularly?

6. Make use of technology

There’s a growing range of apps and software available to help small businesses manage their cash flow. Using technology will give you a real-time view of your cash flow and help you automate time-consuming tasks such as sending and chasing invoices.

There are also apps and software available to help you forecast your cash flow, revenue and expenses. These will enable you to plan ahead, by seeing how different scenarios are likely to affect your business, including price rises, late payments and fluctuating trading conditions. Helping you to spot potential challenges and opportunities early, and make better business decisions, such as whether or not to pass rising costs onto your customers.

7. Make use of the help available when you need it

Your accountant, bank, or financial advisor can give you advice on cash flow management as well as your overall business finances and accounting. There is also a wealth of free and affordable business and accounting support out there for small businesses and start-ups, including accelerator programmes to help you grow.

8. Maintain good business relationships

Being on good terms with suppliers, lenders and clients is essential for small businesses, especially in uncertain economic times. Communicating clearly around finance and working collaboratively will help to strengthen these relationships. For example, offering flexible payment plans for clients could help you avoid the challenge of late or missed payments, and improve your customer service offering.

9. Know the warning signs

As we’ve mentioned, keeping an eye on business credit scores could help you spot that a key client or supplier may be in financial difficulty. Enabling you to take action, avoid unpaid invoices or supply issues, and protect your own business credit score. The earlier you address potential cash flow problems, the easier it will be to stay on track.

10. Seek help before things go too far

Once you start to see the warning signs above, it’s time to take action. Look at what you can do internally, in terms of cutting costs, tightening your credit control processes and diversifying your revenue streams. If that’s not enough, then don’t be tempted to bury your head in the sand. Stay in close contact with your bank, your accountant and your financial advisers and make sure you get the support you need straight away.

The benefits of effective cash flow management

Understanding and managing your business cash flow can help you stay resilient in uncertain times and adapt quickly to changes such as rising prices and supply chain issues. From mitigating financial risks such as late and missed payments, to helping you spot investment opportunities. It can also help you set clear financial goals underpinned by a real time forecast of your cash flow, enabling you to stay on track and flex when you need to and avoid any cash flow issues.

How can we help?

We provide tools and solutions to help business owners make better decisions about their suppliers and customers and understand and manage their own business credit score:

Experian Business Express allows you to run credit checks and monitor any company you work with, so you can spot signs of trouble early on and make informed decisions.

With My Business Profile, you get full visibility of your business credit profile, enabling you to understand what’s affecting your company credit score and preventing you from being able to obtain that all important company finance.