Accurate data powers industry insights

How are businesses adapting to the ever-evolving credit risk landscape in the UK? Get the Experian view on the current commercial credit risk trends and their impact on small and medium-sized businesses.

- Insolvencies - The number of insolvencies and how it compares to the pre-pandemic levels

- Concerns - The main concerns for businesses right now

- Key UK Commercial Credit Metrics - The insight behind them

Accurate data powers accurate risk scores

Lending decisions are made using commercial risk scores. Experian's bureau data sits at the heart of Commercial Delphi, our flagship, proprietary commercial risk score that is the ultimate tool for assessing business creditworthiness. Commercial Delphi transforms bureau data into effective lending decisions: providing small businesses access to a wider, fairer range of credit services, and helping lenders to reach new customers and get the most out of their existing portfolio without increasing risk.

Our latest generation of Commercial Delphi is our most accurate yet, combining an enhanced blend of data assets including Current Account Turnover data and other enhancements to deliver increased predictive power, and better-informed credit decisions.

Inaccuracy costs. We worked with two leading UK businesses to see how enhanced data accuracy reduced their risk exposure.

Watch our video to see exactly what’s new in Commercial Delphi Gen 6 and how it can help lenders like yourself.

Accurate risk scores powered by Commercial Delphi Generation 6

Commercial Delphi Generation 6 is Experian’s latest commercial credit risk score used to calculate the viability of businesses over a 12-month period. Commercial Delphi Gen 6 is more inclusive and with more predictive power than ever. With an increased discriminatory power of nearly 20 percentage points compared to previous versions, it enables more accurate lending decisions across the whole credit lifecycle:

- Generation 3 - 49.3%

- Generation 4 - 53.1%

- Generation 6 - 67.1%

For the first time ever, Commercial Credit Data Sharing information, including Current Account Turnover Data and payment information on credit cards, loans, asset finance and commercial mortgages repayments is used to provide insight into an organisation’s cashflow and how well they pay back credit.

The Director’s Usual Residential Address is used to assess the organisation through the director’s consumer information, building a more comprehensive view of the business and the payment behaviour of its directors.

Plus, recognising the growth of UK start-ups, we’ve updated our scoring segments to include nano and micro businesses, providing tailored scoring for these business types which more accurately reflect the unique characteristics of these businesses.

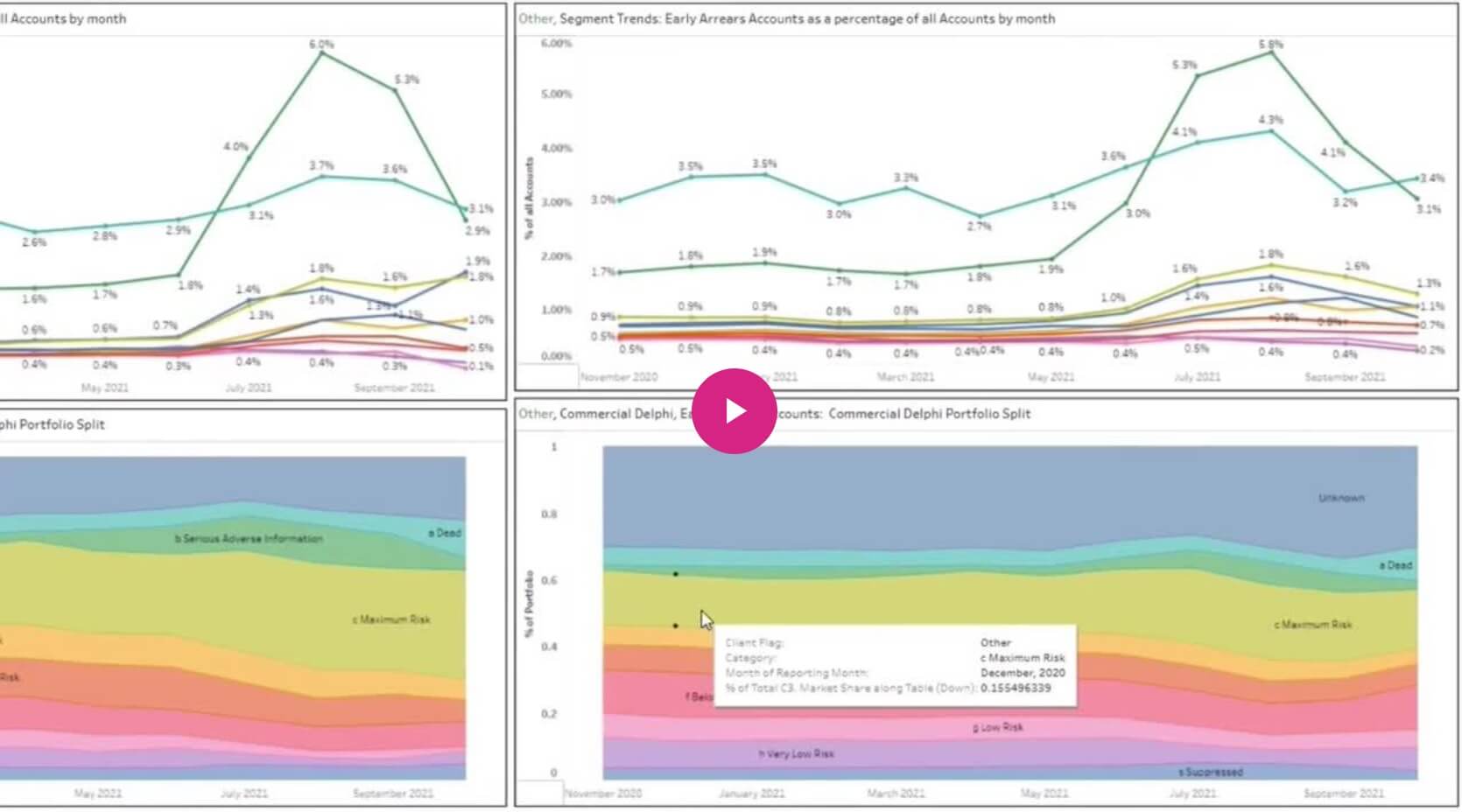

Accurate data analysis with our Commercial CAIS Insight Dashboard

Commercial CAIS is Experian’s commercial data-sharing programme in which members can share and receive aggregated data on current and historical credit repayment information to provide an accurate view of customers payment behaviour.

The Commercial CAIS Insight Dashboard helps members:

- assess their own portfolio

- identify trends and behaviour

- benchmark their performance against the market

Related links

Reduce your bad debt loses with Experian’s latest Commercial Risk Score