Pension data management for the General Code of Practice

The Pension Regulator’s General Code of Practice requires pension providers to implement an Effective System of Governance (ESoG) with strong data quality. In a tightly regulated sector, providers often inherit data they didn’t collect, and it’s rarely reviewed by the data subject, making it difficult to maintain high data standards.

Transform pension data into trusted insights

Pension schemes often struggle with outdated, incomplete, or duplicated member data, making it difficult to maintain accurate records and meet regulatory expectations.

Experian’s automated data management solution empowers pension providers to overcome these challenges by delivering a single, trusted view of each member through advanced data cleansing, enrichment, and reconciliation.

With Experian’s solution, providers can:

- Assist in navigating pension regulation updates

- Improve operational efficiency and reduce manual data handling

- Enhance member engagement, especially for those nearing retirement

- Leverage tools like Aperture Data Studio for continuous data quality

- Use ExPin for precise data deduplication and Supertrace for member reconnection

- Strengthen decision-making and mitigate risk across the organisation

Powering pension providers with data confidence

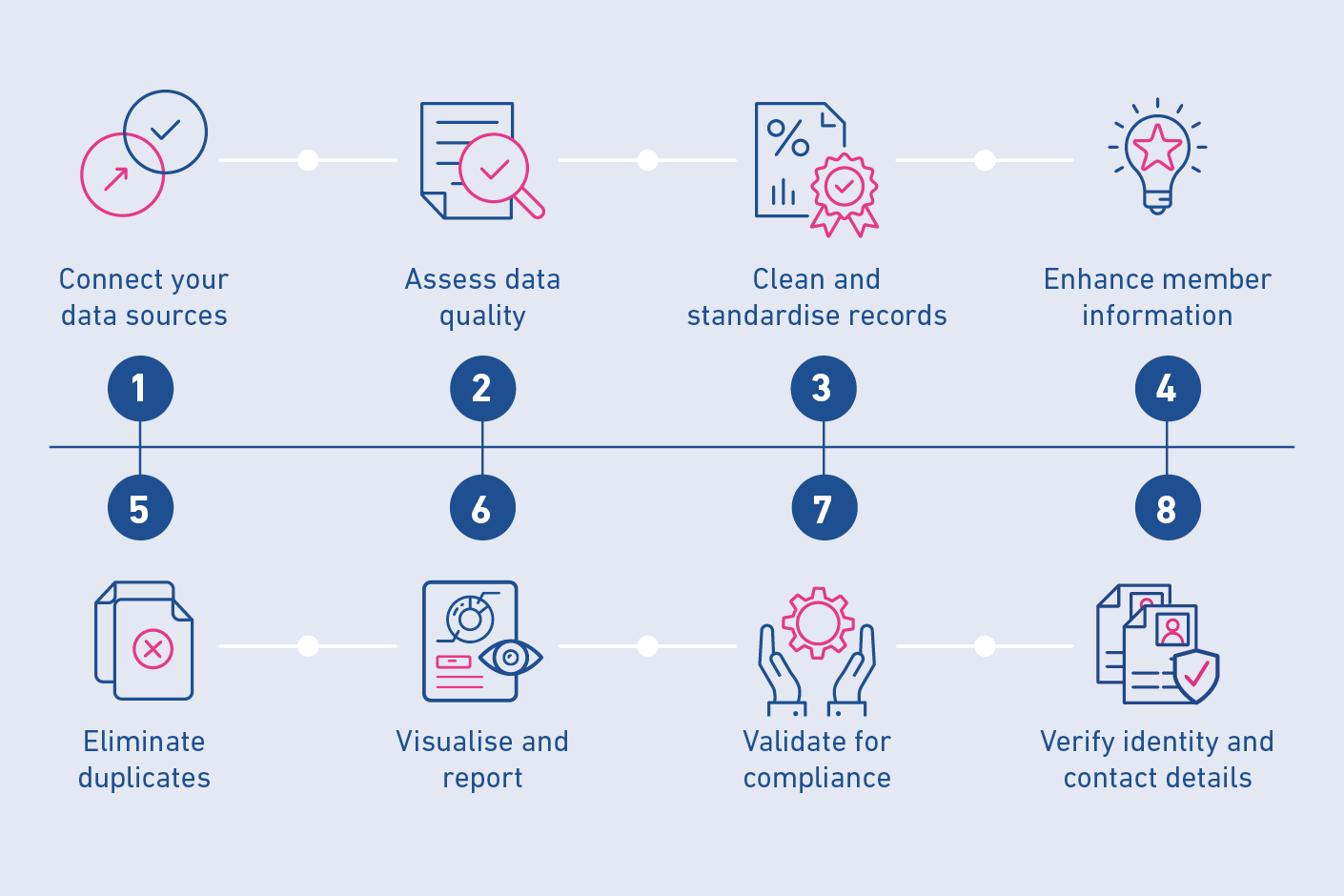

How the process works

- Step 1: Connect your data sources

- Step 2: Assess data quality

- Step 3: Clean and standardise records

- Step 4: Enhance member information

- Step 5: Eliminate duplicates

- Step 6: Visualise and report

- Step 7: Validate for compliance

- Step 8: Verify identity and contact details

Why choose us?

Our solutions

Speak to an expert about pension remediation for your customers.

View our Privacy Policy for details on use and storage of your personal data.

*Denotes a required field