Fast, reliable decisions

In today’s fast-paced world, customers want fast decisions. They don’t want to hang around for time-consuming checks, but, at the same time you need to ensure that you make all the necessary checks. With the right data, decisioning insight, automated scoring and machine learning input you can balance these needs, providing quick, informed decisions to maximise applicants in competitive or new markets.

Solutions for fast, reliable decisions

Make better customer decisions even when operating in a dynamic business environment. Find out how Experian's PowerCurve platform can help you.

Quickly assess a consumer’s financial situation with an online snapshot of their circumstances.

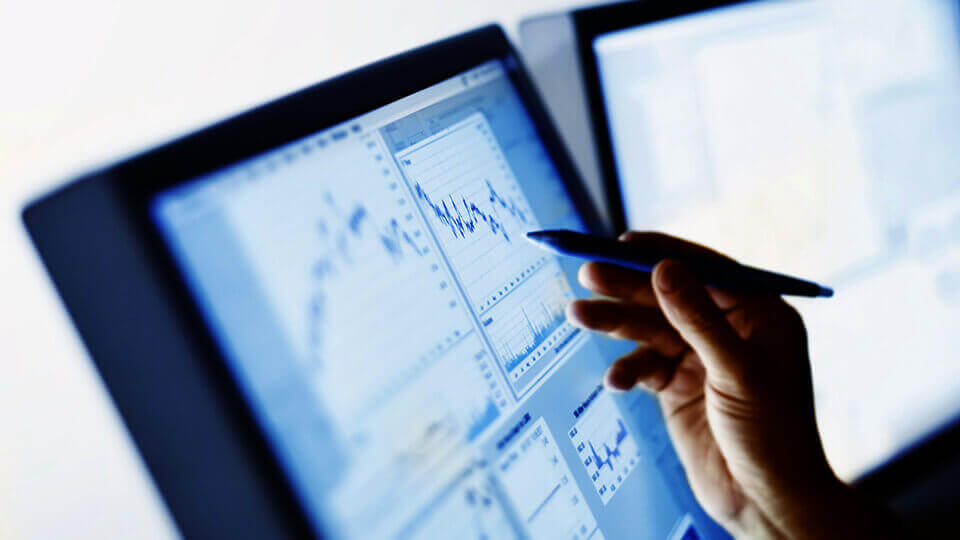

Continually-updated decisioning models

Dynamic decisioning models are essential in today's lending landscape. These models use advanced analytics and process large amounts of data to generate actionable insights that help lenders make informed decisions. As technology advances, decisioning models become more complex, requiring frequent updates to ensure they remain relevant and effective.

Experian offer decisioning solutions that leverage machine learning and other advanced techniques to provide real-time decision-making capabilities. These solutions can be customised to meet the specific needs of each organisation and can integrate with existing systems to streamline decision-making processes. With continually-updated decisioning models, companies can make more accurate and timely decisions that drive better lending outcomes.

Related links

Solutions for updated decisioning models

As market conditions change, PowerCurve Strategy Management can help you develop and deliver more insightful customer acquisition and origination strategies.

Our data and analytics services put transformative software into your hand. Enjoy the benefits of the cloud to power advanced analytics through technology and data.

Better decisioning and underwriting efficiency

Real-time customer data insights can help you make informed decisions, improve customer satisfaction, and enhance your overall customer experience. Identify key decision points, define decision rules, and integrate analytics into your decision-making process. Using advanced analytics and decisioning tools, you can streamline your underwriting processes, reduce risk, and increase your operational efficiency.

Solutions for better underwriting efficiency

Make better customer decisions even when operating in a dynamic business environment. Find out how Experian's PowerCurve platform can help you.

Out-dated scorecards may be misrepresenting customers. By reviewing your lending criteria with a view of today, you can ensure you’re offering the right terms to the right people.

Increase acceptance and lower credit-loss

Advanced analytics and decision-making help reduce credit loss in the financial services industry. By making sense of complex data through advanced modelling, businesses can more accurately assess credit risk, identify potential fraud, and better understand customer behavior. This can lead to more informed decisions, better loan pricing, increased application acceptance and improved collections strategies.

Solutions to help increase acceptance

Experian’s credit line management model helps you set the best credit limit for individual customers, using balance prediction for the most accurate decision making.

PowerCurve Customer Acquisition is an intuitive cloud-based platform that enables you to consistently make one right lending decision after another.

Reduce friction

Appropriate customer data enables you to make informed decisions quickly and accurately. By streamlining your underwriting processes and reducing manual input, you can reduce the risk of errors and minimize customer wait times, improving their overall experience. Identify inefficiencies in your decisioning process to optimise for maximum efficiency, improve customer satisfaction and loyalty, and ultimately grow your business.

Solutions to help reduce friction

Make better customer decisions even when operating in a dynamic business environment. Find out how Experian's PowerCurve platform can help you.

Out-dated scorecards may be misrepresenting customers. By reviewing your lending criteria with a view of today, you can ensure you’re offering the right terms to the right people.