In an age of volatility, precision and agility are key

In today's rapidly changing environment, achieving increased risk accuracy and agility is crucial. Our AscendOps solution is designed to meet these needs by accelerating model deployment into live decisioning and providing robust model monitoring.

- Model development cycles typically take 1-2 years

- 55% of lenders report building models that never made it to production

- 73% of lenders admit to struggling with explaining their models and model outcome

- 82% of institutions state it is difficult to find/retain data science talent

- 59% of institutions agree that monitoring and reporting requires the most time and resources

- 73% of institutions recognise ModelOps will shape the industry’s future over the next 5 years

What is AscendOps?

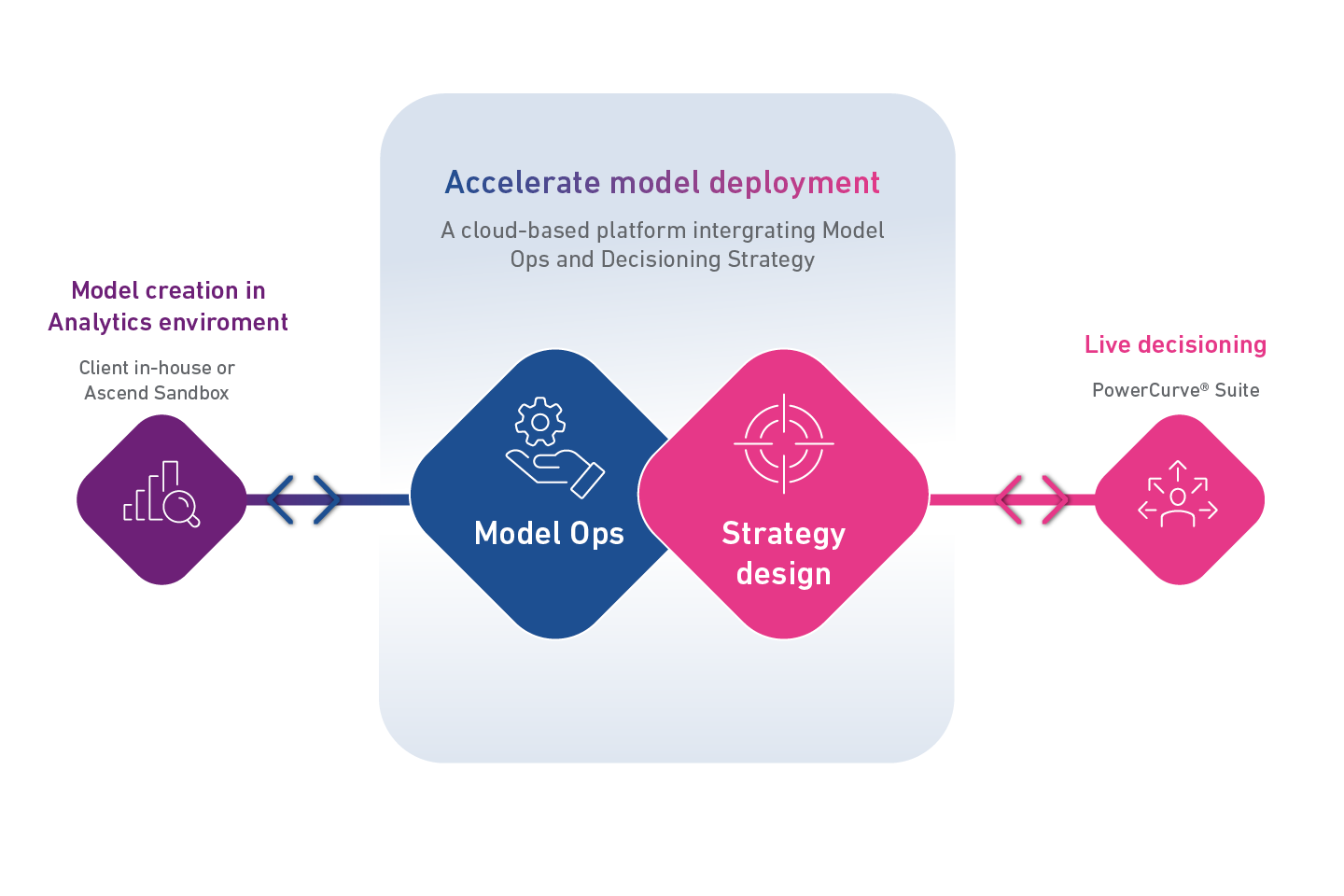

AscendOps is our cloud-based solution that accelerates deployment and provides hosting of models, enabling clients to utilise the latest scores to make better decisions, transition simpler, and generate Return On Investment faster. It significantly reduces the time to market for custom features and models.

Let's talk

Why our clients love AscendOps: Streamlined, Flexible, and Empowering

How it works

Register your model

Leverage accelerators to speed the registration of your features and models.

Test and validate

Development tests and user acceptance tests for batch and real-time use cases.

Promote to production

Limited-click model deployment process with one-click deployment to production.

Live decisioning

Manage features and models all in one place with Ascend Ops Manager and track drift, performance, and operations.

Our AscendOps solution, combined with our Analytical Sandbox and Decisioning capabilities, offers a comprehensive solution for model development, deployment, and decisioning. Our integrated approach ensures that you can move from data to decisioning quickly and efficiently, providing a positive return on investment and enhanced risk management.

Request a call back

Enter your details and we'll be in touch.

View our Privacy Policy for details on use and storage of your personal data.

*Denotes a required field

*Research findings taken from Experian Model Ops Research conducted in June 2023 with 415 consumer lending Organisations in UK, North America and Brazil.

**Experian Research 2023 - Model deployment timelines for financial institutions.

***May vary based on clients own internal governance process.